Rising interest rates in the US and Europe are forcing environmentally focused investors to rethink a market long-considered a laggard on everything ESG: Asia.

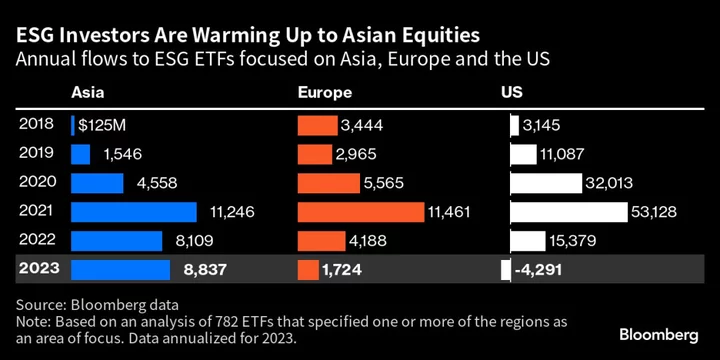

Asia’s climate and ESG-labeled equity exchange-traded funds are attracting the most inflows versus US and European peers since at least 2010. Fund launches are up. Even ESG funds sold in Europe are steadily increasing their exposure to Asia.

Asian companies are sheltered — at least on a relative basis — from the high-and-rising rates that are putting pressure on green energy investments, said Vicki Chi, a Hong Kong-based portfolio manager at Robeco. Valuations are “very reasonable” and the region is “way under-investigated, way less hyped as a whole,” compared with developed countries, she added.

A boom in climate-related funds in China and Japan has drawn more than $6.5 billion to ESG ETFs that invest in the Asia-Pacific region. The sector is on track to attract $8.8 billion by the end of the year, data compiled by Bloomberg show.

By contrast, investors in comparable US funds are on pace to withdraw $4.3 billion on an annualized basis, as the Federal Reserve’s rate hikes since last March have ballooned to 525 basis points. In Europe, the biggest market for ESG investing, ETF inflows will be just under $2 billion.

In the first half of 2023, Schroders Plc and other managers opened 47 new ESG funds domiciled in Asia Pacific across asset classes, according to researchers at Morningstar Inc. At the same time, Europe’s existing ESG funds are allocating incrementally more money to Asian investments — 11% at the end of July, up from 10.6% at the start of the year. Meanwhile, overall ESG fund launches in Europe are down 60%, compared with last year.

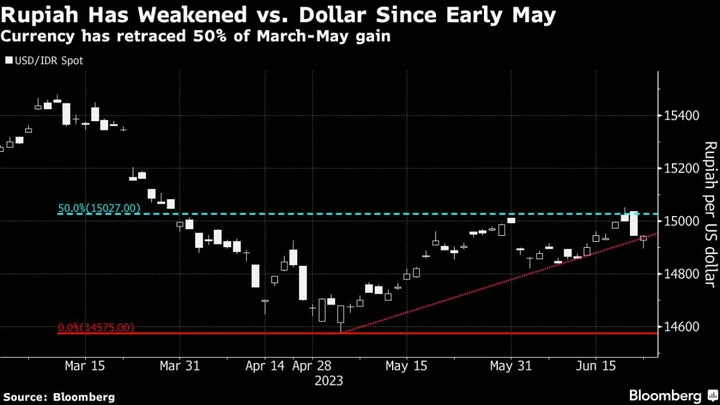

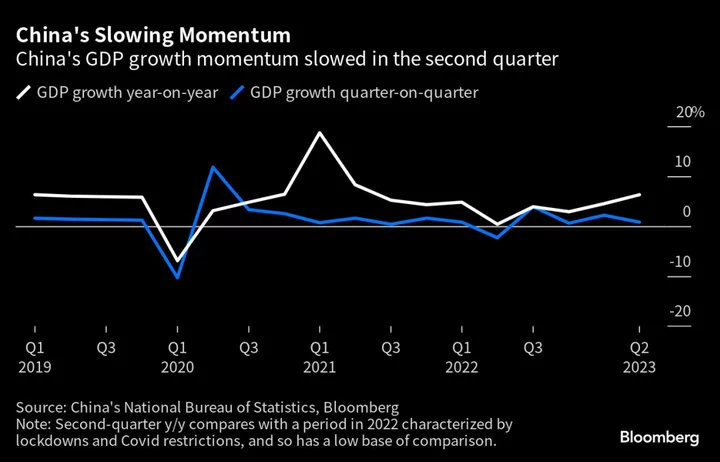

Asia has been making steady gains among ESG investors, particularly those looking for less fraught, less bureaucratic alternatives to the US and Europe. This year, the region has particular appeal because inflation rates are lower and central banks have either stopped raising interest rates or are cutting them. That’s a boon for renewable- and clean-energy focused investments, which tend to rely heavily on debt to finance projects.

In China, for example, falling interest rates are prompting investment in solar power plants, according to BloombergNEF. India, where most analysts expect the central bank to keep rates on hold for the foreseeable future, has become a rare bright spot in the onshore wind market. Shares of Indian wind turbine maker Suzlon Energy Ltd. have doubled this year, a sharp contrast with Danish rival Orsted A/S, which plunged the most on record in August following a warning of impairments tied to surging rates.

The fund inflows in Asia partly “reflect investors’ perception that rates have likely peaked and, therefore, the next few years will support equity valuations via potential rate cuts,” said Xuan Sheng Ou Yong, ESG analyst at BNP Paribas Asset Management in Singapore.

In the US, policymakers left the target range for their benchmark rate unchanged earlier this month at 5.25% to 5.5% — a 22-year high. But fresh quarterly projections showed 12 of 19 officials favored another rate hike in 2023, underscoring a desire to ensure inflation continues to decelerate.

Regulatory Moves

In Asia, regulators also have improved environmental and governance reporting. China introduced more than a dozen policies in 2021 alone. It’s also increased green bond regulation, added disclosure requirements for major emitters and launched a compliance carbon-trading system for the power sector, Sanford C. Bernstein strategists Zhihan Ma and Rupal Agarwal highlighted in a July note.

India and Japan have tightened oversight of ESG ratings providers, while Singapore and Hong Kong now require reporting aligned with emerging global standards. In Australia, authorities have proposed new required disclosures to capture supply-chain emissions.

“The more data we have, the better we can paint an accurate picture of what companies are really doing on the ground in terms of their sustainability integration or management,” said Stephanie Choi, sustainable and impact investing strategist at UBS Global Wealth Management in Hong Kong.

The combination of favorable rates, more investor awareness of environmental themes and better pricing for the region’s clean energy and electric vehicle stocks make this a good time to invest, said David Smith, a portfolio manager at Abrdn Asia Ltd. Valuations are “really quite attractive,” he said.

Moreover, the overall thesis that companies at the forefront of the energy transition will outperform in the long run still holds, according to the Bernstein analysts.

Total assets in Asian active and passive equity mandates were just $119 billion at the end of June, about 5% of Europe’s and less than half of that in the US, according to Morningstar, leaving room for growth particularly at a time of heightened political and regulatory risks for ESG funds.

“At a time when ESG has come under pressure in the US, we are seeing a new dawn for ESG investing in Asia,” Bernstein’s Ma and Agarwal wrote.

--With assistance from Sheryl Tian Tong Lee, Joao Abrantes, Akiko Itano, Matthew Burgess, Subhadip Sircar, David Finnerty and Patrick Winters.

(Adds details about outlook for US rates in 10th paragraph.)