Britain’s inflation rate is likely to fall at the sharpest pace in more than 30 years when April figures are reported on Wednesday, giving households a glimmer of relief from the worst cost-of-living squeeze in generations.

The Consumer Prices Index is expected to tumble to 8.2% last month from 10.1% in March, according to a Bloomberg survey of economists. The drop is due to sharp increases in energy prices a year ago falling out of the comparison.

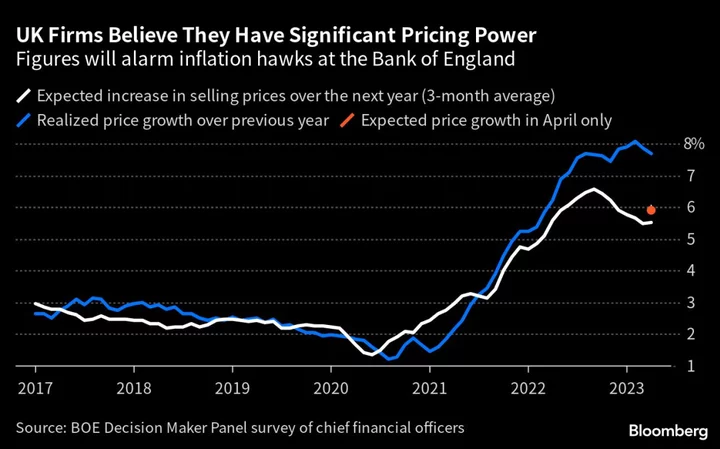

While the forecast is more sunny than in previous months, the actual figures reported have surprised on the upside in the past two months. It’s a crucial set of figures that are hotly anticipated by the Bank of England and investors and will test bets on policy makers lifting interest rates to as high as 5%.

The release will provide Governor Andrew Bailey the most important evidence yet on whether he can follow the US Federal Reserve in opening the door to a pause in a 1 1/2 year long series of rate increases.

“The next UK inflation number could be huge,” said Mike Riddell, a macro portfolio manager at Allianz Global Investors. “If we see an uptick in core inflation, then the market could easily price in a BOE base rate peaking above 5%.”

Inflation came in higher than expected in the previous two months, and another upward surprise would entrench investor bets on the central bank plowing ahead with more hikes through the summer.

However, Bailey has said he is now looking for “evidence” of cooling price pressures that could allow the Monetary Policy Committee to “rest” after 12 consecutive hikes. Riddell cautions that if inflation slows more than forecast, investors who have sold UK bonds in anticipation of higher rates, may rush to buy them back, resulting in “a big move lower in gilt yields.”

What Bloomberg Economics Says ...

“We expect April data to show CPI gains dropping back into single digits as last year’s bump in household energy bills falls out of the annual comparison.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the WEEK AHEAD note.

Markets are still leaning toward the BOE’s key lending rate hitting 5% by September, up from 4.5% currently. But the tone of comments from central bank policy makers will depend on whether April’s reading reinforces fears of stickier prices. It’s the first of two batches of CPI data the BOE will evaluate before its next decision on June 22.

“The onus is now on the data to prove that further tightening will be required,” said Imogen Bachra, head of UK rates strategy at NatWest Markets. “The combination of rapidly falling headline inflation and evidence of cooling labor demand should, therefore, provide the BOE with some breathing room to take their foot off the gas.”

The release is widely expected to confirm an end to seven consecutive months of double-digit inflation, easing some of the pressure on the BOE.

Bank officials expects April’s inflation to come in at 8.4%. The last time the rate dropped more sharply was in April 1992, a year after inflation had been spurred by Norman Lamont’s 1991 budget, which included an increase in VAT and numerous duties.

The sharp decline in inflation in April this year will also be driven by powerful base effects as last year’s surge in energy prices will fall out of the annual calculations.

“Any signs that inflation is moving like the BOE are expecting it to move should warrant a pause,” said Evelyne Gomez-Liechti, rates strategist at Mizuho International Plc. “Even if Wednesday’s data shows inflation slowing down sharply, they would want to see how the May inflation and wages data come out.”

However, markets are not yet convinced that the evidence to prevent the BOE from hiking further is materializing with previous surprises driving hike bets higher.

An analysis of rate hike pricing on days when inflation figures were published this year shows a clear preference to add to rate hike wagers — by as much as 25 basis points — on the occasions when the data came in hotter than expected.

Money markets are betting on a further half-point increase to a 15-year high at 5% by September where they are expected to remain on hold until the first rate cut by May, according to swaps tied to policy-meeting dates.

Looking further ahead however, the scale of easing is no match for Federal Reserve expectations. While the BOE is expected to lower interest rates to 4% within two years, forward swaps are pricing the key US rate — which is currently higher than the UK bank rate — below 3%.

“Our view is that the markets have read the May Monetary Policy Report a bit wrongly,” said Andrew Goodwin, chief UK economist at Oxford Economics. “Markets are almost suggesting that the default is they go again.”

--With assistance from Harumi Ichikura.

(Updates with line on surprises in third paragraph.)