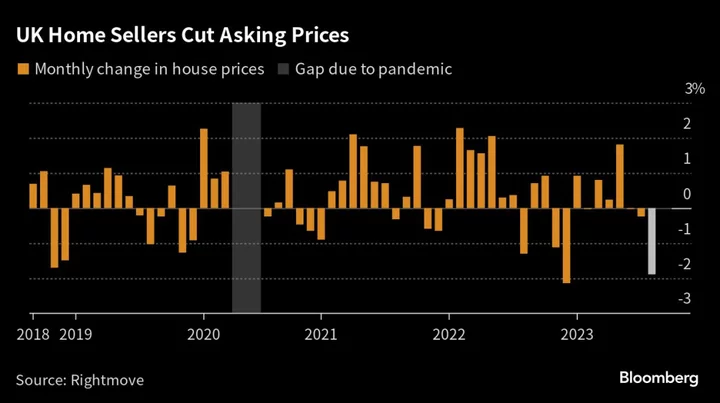

UK property sellers cut the prices they’re asking at the sharpest pace since December, adding to evidence that soaring interest rates are weighing on the ability of buyers to afford purchases.

The property portal Rightmove said its index tracking the cost of homes coming to market fell 1.9% to £364,895 ($465,620) this month. It was the biggest decline for August since 2018 and the sharpest drop since the end of last year, when sellers were trying to wrap up deals.

“The market is difficult for many right now after the more buoyant couple of years previous,” Mike Cole, managing director at Imagine Property Group, said in the report released Monday. “Sellers need to be realistic about the current market climate.”

The figures are among the most forward-looking evidence of weakness in the housing market, which strengthened earlier in the year but more recently has lost momentum. Mortgage lenders say prices are now falling at some of the sharpest rates since the global financial crisis more than a decade ago, and surveyors say estate agents have turned more gloomy in recent weeks.

Asking prices reflect the bartering buyers and sellers go through to reach an agreed price and often track the figures reported weeks later by lenders. The Land Registry is the most authoritative measure of prices on completed deals but lags Rightmove and figures from the lenders by several months.

Mortgage lending rates have surged to the highest in more than a decade after 14 consecutive hikes from the Bank of England. Policy makers are struggling to contain inflation that remains more than triple the 2% target.

Rightmove said the drop in asking prices was most marked among sellers at the top of the housing ladder — those in detached four-bedroom houses or homes with five beds or more. Those suffered a 3.4% plunge in asking prices. First-time buyer properties fell by 0.9%.

The number of sales by Rightmove’s measure is now 15% below pre-pandemic levels in 2019. That reflects both a drop in buyer interest and a 10% fell in the number of properties on the market.

Asking prices are now 2%, or £8,000 below the peak in May but 19% higher than they were four years ago in August 2019.

“It really is a two-speed market right now,” said Vicki Foreman, associate partner at the Norfolk-based estate agent Brown & Co. “Homes which are overpriced compared to local trends really stand out from the crowd for the wrong reasons and have the real risk of going stale. On the other side, there is still a healthy level of buyer interest for well-priced new instructions.”

Read more:

- London House Prices Record the First Annual Drop Since 2019

- UK Home Sales Drop to Lowest Level Since Pandemic, Surveyors Say

- UK House Price Declines Deepen as Borrowing Costs Cut Demand

- UK Property Rental Prices Rise at Fastest Pace Since 2016

- UK House Prices Fall for a Fourth Straight Month, Halifax Says

--With assistance from Eamon Akil Farhat.