The supply of new UK rental properties rose the most since November 2022 in an early sign of relief for squeezed-out tenants.

The number of new rentals coming to the market increased 7% in the three months to September, compared with the same period last year, according to a Rightmove report published Thursday. That helped lift the total number of available rental properties by 14%, while demand dipped 17% over the same period.

“While it is likely that there is some way to go before this filters through to rental prices, we could start to see the pace of yearly rent rises slow more significantly than it has been,” said Tim Bannister, director of property science at Rightmove.

The shift could ease a shortage of properties to rent that’s increased rental costs at a record rate, adding to the worst cost-of-living squeezes in generations. With mortgage costs significantly higher than a year ago, more tennants are stuck renting property at a time landlords are selling out.

The report also showed:

- The number of tenants looking to move the third quarter remained 41% above 2019 levels.

- The number of first-time buyers for homes across Britain fell 22%.

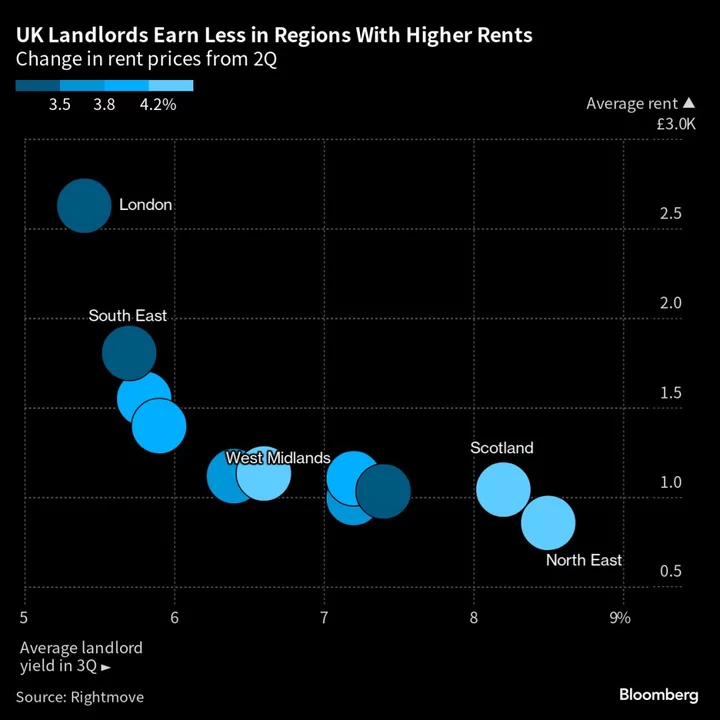

Average rents in London hit a record £2,627 in the three months to September, a 12% rise from the same period last year. Outside the capital, rents jumped 10% to £1,278 per month, the report showed.

For now, agents are reporting fierce competition for every rental unit that comes on the market. Would-be tenant inquiries per flat more than tripled compared with the situation before the pandemic. The numbers count people asking about property by phone, email and queuing for viewings.

“The gap between high demand and a severe shortage of rental stock at the moment is just crazy,” said Ria Laitmer, lettings manager at Clarkes in Dorset. “We’re receiving mounting inquiries for each property to rent from would-be tenants, with queues of tenants arriving to open-house viewings and the majority being left disappointed as there is just not enough properties on the market.”