The UK economy is larger than previously thought, new figures show in a boost for Prime Minister Rishi Sunak days before his Conservative Party begins its annual conference.

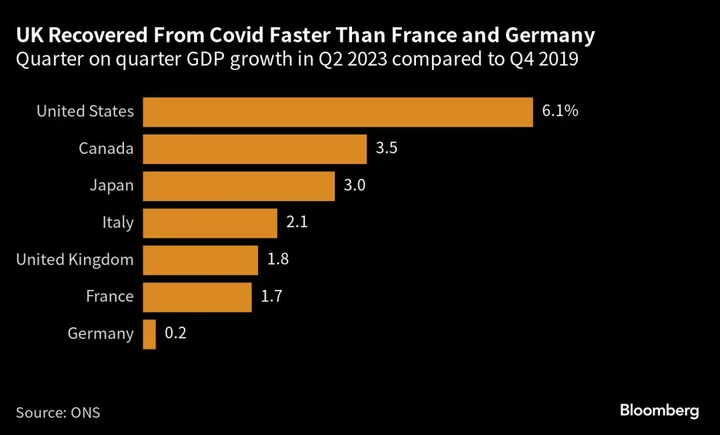

The upward revision announced by the Office for National Statistics Friday means Britain is no longer lagging every other major industrial nation in its recovery from the pandemic. Germany and France are now at the bottom, with the UK third to last.

The UK economy was 2% bigger in the second quarter than previously estimated after recovering all the output lost during the pandemic by the end of 2021. It leaves GDP 1.8% above pre-Covid levels.

The pound rose 0.3% to around $1.2241 after the release, the strongest level since Monday. The move came a weaker greenback lifted currencies across the board. It was little changed against the euro.

Germany is just 0.2% bigger than pre-pandemic levels and France 1.7% larger.

UK growth for last year as a whole was also revised up to 4.3% from 4.1%. The bulk of the overall improvement was driven by upward revisions in 2021, as the UK bounced back from the deep Covid recession. Growth was 8.7% in 2021, up from an earlier estimate of 7.6%.

The figures will be seized on by ministers as evidence of resilience in the face of the worst cost-of-living crisis in decades. For Sunak, they are perfectly timed, with the Conservatives heading for their annual get-together against a backdrop of dire opinion poll ratings a year before an expected general election and splits over the future of a flagship rail project.

“Data out today once again proves the doubters wrong,” Chancellor of the Exchequer Jeremy Hunt said in a statement. “The best way to continue this growth is to stick to our plan to halve inflation this year, with the IMF forecasting that we will grow more than Germany, France, and Italy in the longer term.”

Sunak has made cutting inflation in half this year and growing the economy key elections pledges.

Second quarter figures showed:

- The economy grew 0.2%, unrevised from the previous estimate, as activity was held back by widespread public-sector strikes over pay and the cost-of-living squeeze.

- Real disposable incomes rose 1.2%, with wages and benefits rising faster than prices, easing a brutal cost-of-living squeeze. The ONS cited public-sector pay settlements as a cause.

- The saving ratio, the proportion of income left over after spending on goods and services, rose to 9.1% from 7.9%.

- The current-account deficit widened to £25.3 billion ($31 billion) from a revised £15.2 billion.

The GDP revisions through the second quarter bring the national accounts up to date, showing how the economy fared during a period of rising inflation and interest rates. On Sept. 1, the ONS announced revisions to the end of 2021 that partially rewrote the narrative of the pandemic. Using new methodologies, statisticians found the health-care sector in particular produced more than previous thought.

The changes since 2021 help to explain why the BOE has struggled with inflation: the economy has been running hot. They also suggest British workers were more productive than first reckoned. For the public finances and fiscal policy, there may be few implications as the figures say little about how well the economy will perform and generate tax revenue in the future.

Despite the upgrade, Britain’s performance during 2022 and the first half of 2023 has been comparatively lackluster, with GDP growing 1.2% in total. Every other country except Germany posted faster growth over those 18 months.

The UK’s relative performance may still change. Britain is one of the first countries in the world to review its accounts using new approaches. When others follow suit, the G-7 league table could get rewritten again.

--With assistance from Lucy White, Irina Anghel and Constantine Courcoulas.

(Updates with market reaction and chancellor comment.)