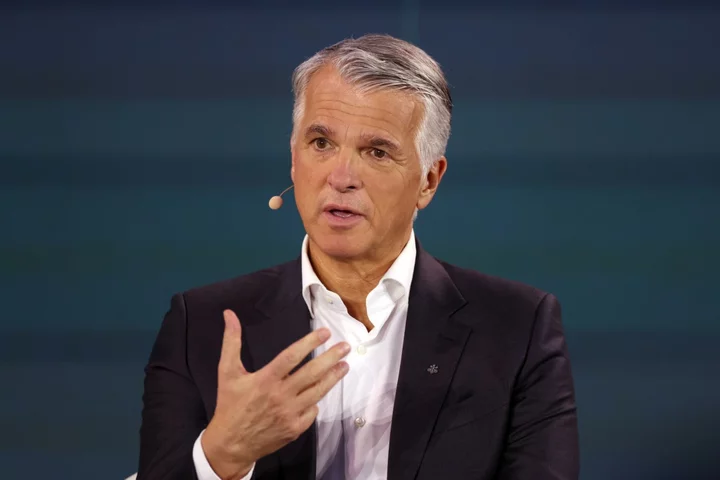

UBS Group AG’s chief executive officer pushed back against suggestions that cultural differences between his bank and Credit Suisse are complicating the integration of the former rival.

“I don’t think that per se there is a cultural clash between the two organizations,” Sergio Ermotti said at the Bloomberg New Economy Forum in Singapore on Thursday. “We have been competing very fiercely but basically, more or less, with the same business model.”

The remarks contrast with comments by Chairman Colm Kelleher, who said shortly after the government-brokered rescue of the rival in March that Credit Suisse employees would be put through a culture filter to make sure they fit with UBS’s conservative approach. Since then, investor concerns about the deal have largely abated, while motivating top employees to stay has become a challenge as competitors stepped up poaching efforts.

UBS offered about $500 million in retention packages to Credit Suisse staff during the period between the deal announcement in March and its close in June, according to its quarterly report. Even so, Credit Suisse has lost about 500 client advisers over the past 12 months, resulting in the loss of $20 billion worth of client assets.

The “processes, policies, risk management approaches are UBS,” Ermotti said Thursday. “So we just clarified this matter in a way that avoids potential conflicts.”

UBS has also been going through Credit Suisse’s clients and their assets since closing the deal as it seeks to ensure the acquired businesses conform with its risk approach. It plans to exit $5 billion in assets it manages for rich customers, while about $30 billion in the wealth unit were reclassified as “related to non-strategic relationships.”

--With assistance from Joyce Koh.