Taiwan Semiconductor Manufacturing Co. has agreed to build a €10 billion ($11 billion) plant in eastern Germany in partnership with Infineon Technologies AG, NXP Semiconductors NV and Robert Bosch GmbH.

The planned fab will be 70% owned by TSMC, which will operate the facility in the city of Dresden, with Infineon, NXP and Bosch each holding 10% equity stake, subject to regulatory approval, the companies said Tuesday in a joint statement.

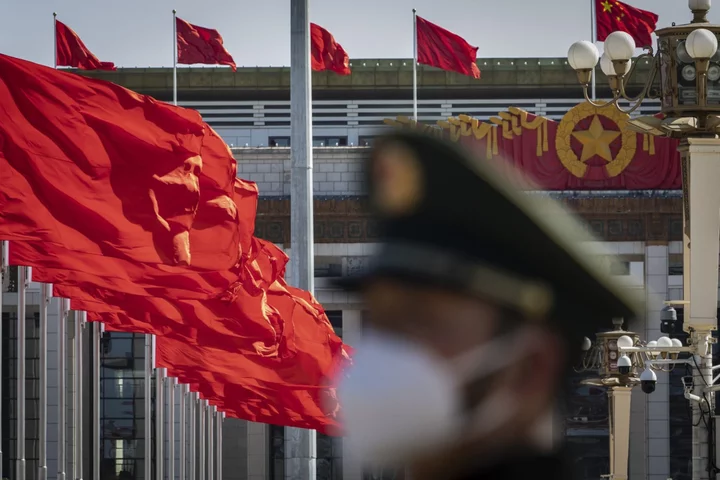

The plant, which is meant to begin production by the end of 2027, will provide chips for the automotive and industrial sectors and is a first step for TSMC in establishing a major European presence to counter risks from escalating US-Chinese tensions.

The new site is a boost to European efforts to reduce its reliance on Asia for importing vital components and comes after German carmakers including Volkswagen AG and Porsche AG highlighted their keen interest in having a TSMC plant in Europe’s biggest economy.

Chancellor Olaf Scholz’s ruling coalition will provide as much as €5 billion in subsidies for the factory, Bloomberg has reported.

Governments around the world are competing fiercely for new chip factories to secure more control over semiconductors critical to most electronics and next-generation technologies, including AI.

TSMC, the main chipmaker for Apple Inc. and Nvidia Corp., has already approved major projects from the US to Japan to mollify customers concerned about a conflict in the Taiwan Strait.

Read more: EU Approves €8 Billion in State Subsidies for Chip Research

Beijing’s military has shown increasing signs of aggression as the Biden administration wields sanctions and trade restrictions to contain China’s rise.

TSMC has committed to creating two advanced facilities in Arizona with a total price tag of $40 billion, and is building an $8.6 billion plant in Japan with support from the government in Tokyo, Sony Group Corp. and Denso Corp.

Meanwhile, EU negotiators this year agreed on a final version of a €43 billion plan to help Europe manufacture 20% of the world’s semiconductors by 2030.

Germany has emerged as one of the most aggressive countries chasing after more domestic chip manufacturing. Scholz’s government is expected to approve a plan this week to top up a fund targeting semiconductor production, along with climate-protection measures, by about $22 billion, according to people familiar with the discussions.

Intel Corp. is set to receive about $11 billion in subsidies from the government in Berlin for its own chip complex.

--With assistance from Agatha Cantrill.