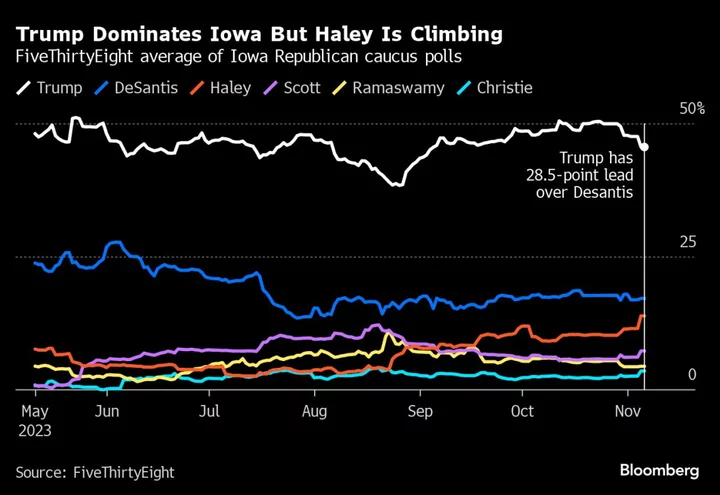

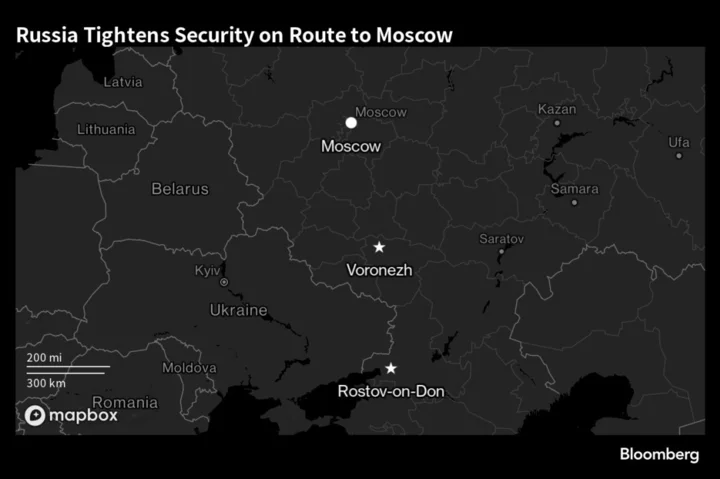

Good morning from Washington, where Congress is up against a Nov. 17 deadline when government funding runs out.Donald Trump—who wants to return to Washington as president—is stepping up his campaign in Iowa, seeking a victory in the Republican caucuses in January that crushes his competitors. Clearing the field has been Trump’s de-facto goal since he announced his 2024 presidential bid a year ago and the legal cases against him risk becoming more than a distraction as they unfold next year. Right now, Bloomberg/Morning Consult polling finds that swing-state voters prefer the former president to incumbent Joe Biden on foreign policy. Biden will pursue US-China diplomacy at a summit with Xi Jinping on Wednesday.

Weight-loss and diabetes drugs are all the rage, generating the kind of buzz that led a Saturday crowd in a Philadelphia to erupt in applause when Danish drugmaker Novo Nordisk presented data on Wegovy's additional benefits as a heart treatment. People are increasingly pressing for weight-loss drugs to be added to health plans and Novo, which also makes Ozempic, is expanding production.

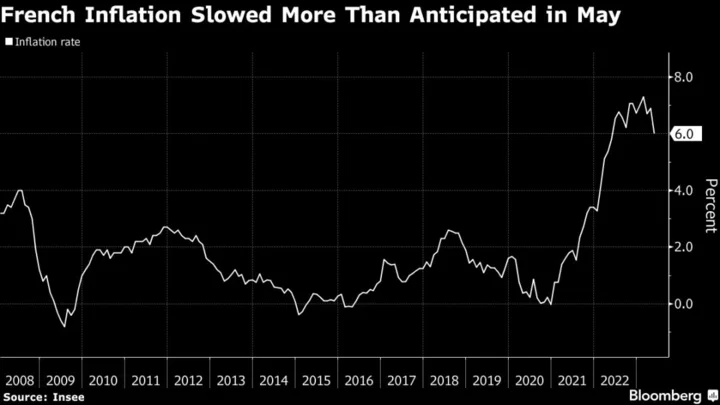

Most people in the US are feeling the housing-market crunch after the Federal Reserve jacked up borrowing costs to fight inflation. Owners of high-end properties in Los Angeles have faced a particular set of challenges: a luxury tax and turmoil in the entertainment industry. One way to generate cash if you can’t sell that mansion on the beach is to rent it out. How about $150,000 a month? Then again, US mortgage rates just fell by the most in more than a year.

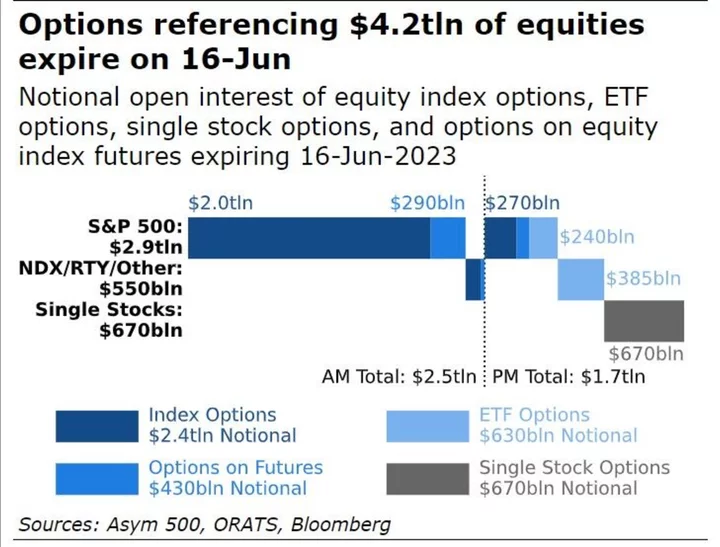

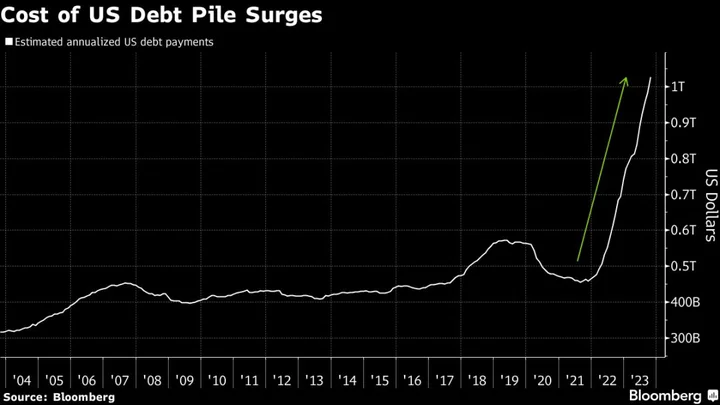

And what to make of US stocks? Big Tech helped lift the S&P 500 back to heights last seen in September, outweighing shaky consumer sentiment and Fed warnings against, well, exuberance on beating inflation. With investors evidently uncertain about where the US economy will end up, next week’s earnings reports by consumer bellwethers such as Walmart and Target will offer signals. On Capitol Hill, signals are pointing toward a US government shutdown unless Congress resolves its partisan deadlock by Nov. 17. Moody’s cited political polarization in Washington when it lowered the US’s credit-rating outlook.

If you aren’t feeling the gloom, you could head to Las Vegas, where Peter Luger has opened a steakhouse outpost that’s a contrast to its no-frills Brooklyn flagship. Opened in the Caesars Palace hotel just in time for the inaugural Formula 1 Grand Prix in Vegas, the place has more than $1 million of beef in its meat aging room. If diamonds are your thing, buy now.

Drought has lowered water levels at the Panama Canal, disrupting ship traffic and causing congestion for freight ahead of the holiday season. Shippers are bidding up canal crossing prices as they try to jump the line in an unusual traffic jam.

Finally, that famous 60/40 formula that always seems to hover over your investment portfolio. Part of the problem with that time-honored split between stocks and bonds is that its goal tends to be poorly defined, Allison Schrager writes in Bloomberg Opinion. A transition to a high-rate environment will mean choppy markets for years to come, and this will test the simple strategies the finance industry relies on, she says.

Enjoy your Saturday. We'll be back tomorrow for a preview of what's happening next week.