Treasury yields are primed to edge lower over time as the Federal Reserve keeps interest rates higher for longer before eventually cutting at a slower pace than markets expect, according to Bank of America Corp.’s Mark Cabana.

“It’s a lot more difficult for us to envision 10s at 5% than it is 10s at 3%,” the head of US interest rates strategy said on Bloomberg Television on Wednesday. “You are not going to see as rapid of a yield decline, but we still think the yields will be moving lower in time as the Fed does indeed move to cuts, just cutting slower than the market anticipates.”

Cabana said the bank’s strategists have recommended clients trade the back end of the Treasury curve with a “tactical long bias.”

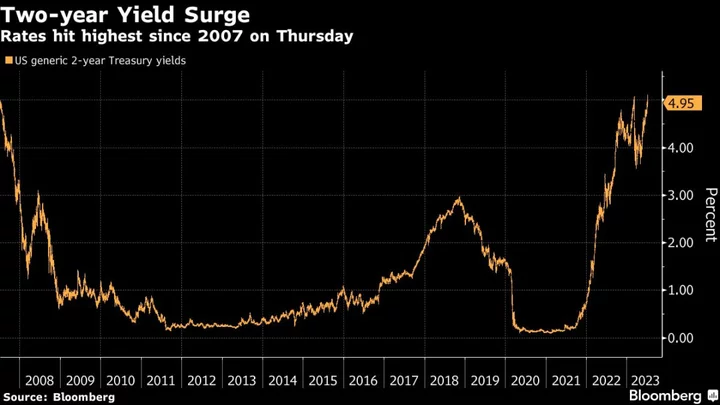

Swaps traders assign about a 40% likelihood of another quarter-point Fed rate increase this year, but by the end of next year they price in rate cuts totaling more than 125 basis points.

Philadelphia Fed President Patrick Harker said Tuesday the central bank may be able to cease rate increases, barring any economic surprises, though rates would need to stay at their current elevated levels for some time.

The Treasuries curve flattened Wednesday, with the 10-year yield falling to around 4% ahead of a $38 billion offering of the maturity later in the day. The yield is down about 20 basis points from levels seen last week, when it approached a multi-year peak, in part after the Treasury announced a larger-than-projected refunding slate.

Cabana said what will ultimately trigger a move to lower yields is some sort of economic driver, such as the release of US inflation data for July on Thursday. The July consumer price index is expected to show annual core inflation easing to 4.7% from 4.8%, a level that was eclipsed in 2021 for the first time in decades.

“We need to see the economy provide cover for investors to justify that long duration bias that they appear to be holding, especially on the real money side,” he said. “CPI tomorrow should fully move us in that direction, but you really need to see signs of broader economic moderation and right now the data is not providing that.”