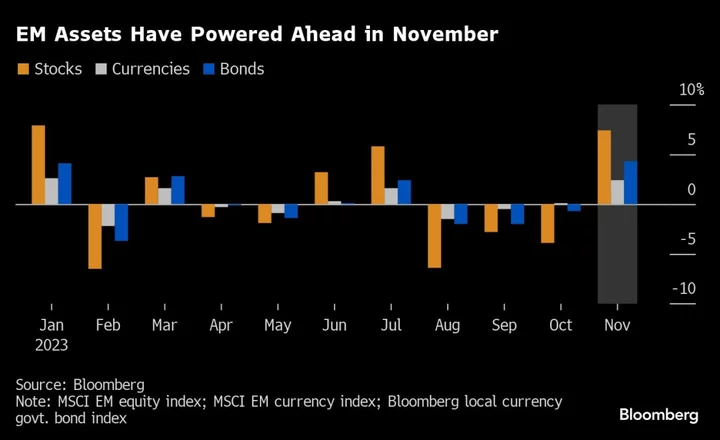

Emerging Asian bonds may struggle to sustain gains spurred by the rally in Treasuries as bearish signals grow.

A Bloomberg index of total returns on emerging Asian bonds jumped from almost a one year low in late October to the highest in two months amid signs the Federal Reserve may have ended its rate-hike cycle. Heavier positioning, rich valuations, weaker auction metrics and the volte-face hawkish pivot from regional central banks recently suggest that further gains may be limited.

Here are four charts that show headwinds to a strong rally in emerging Asia bonds from current levels:

1. Foreign Positioning

Foreign positioning is the heaviest in India as rupee bonds saw large inflows over the past 12-months, which were at 1.3 standard deviations above the five-year mean. Indonesia, Malaysia and South Korea have also seen foreign holdings increase compared with the end of 2022. That raises the risk of an outflow in case bearish bets on Treasuries resurface on inflation concern.

2. Spread Versus Treasuries

Richer valuations on emerging Asian bonds relative to Treasuries are also reducing their attractiveness. The Philippine 10-year note offers a yield spread of around 230 basis points above 10-year US bonds, which is one standard deviation below the five-year average. Its neighbors too have loftier valuations, with the same gauge for Malaysia at 2.7 standard deviations below the five-year rate differential.

3. Weaker Auction Metrics

Easing demand for bonds at auctions also signals that the balance of risk is tilted toward higher local yields. The average bid-to-cover for Malaysia and Indonesia bond auctions in October fell to 1.97 and 1.85 times respectively, down from August, which saw 2.11 and 3.69 times demand.

For Indonesian bonds, the higher-than-expected sovereign debt supply in the fourth quarter has also raised the sensitivity to US rates.

4. Higher-for-Longer

Bank Indonesia’s unexpected 25-basis-point rate hike in October and Bangko Sentral ng Pilipinas off-cycle quarter-point increase in the same month have raised hawkish bets in the region. While there are no signs that other emerging Asian policymakers will resume tightening, the Fed’s higher-for-longer mantra has also pushed back expectations for rate cuts in the region.

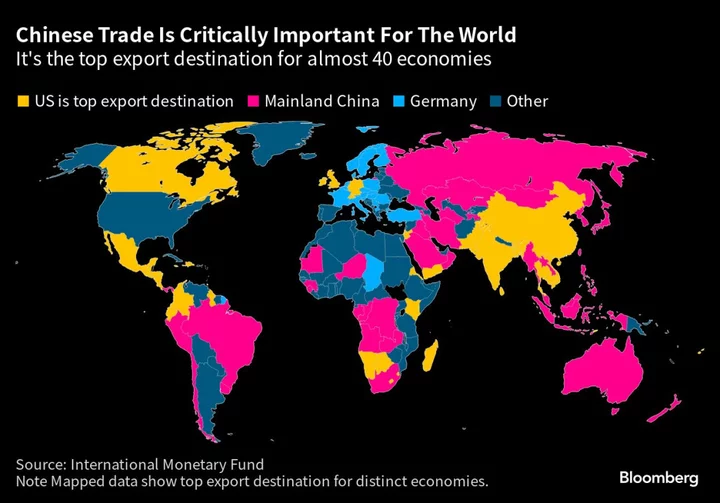

That has put emerging Asian bonds at a disadvantage compared with peers in Latin America as well as those in Central and Eastern Europe, where easing inflation has opened the door for their central banks to take a dovish stance. India will release October inflation statistics on Nov. 13.

“It is doubtful that any Asian central bank will cut rates ahead of the Fed,” said Alvin Tan, head of Asia FX strategy at RBC Capital Markets in Singapore. Aside from the People’s Bank of China which may cut interest rates, he added.

RBC sees the Fed cutting rates from 2Q 2024 onward and expects that to open the door for Bank Indonesia and Bank Negara Malaysia to begin cutting rates by mid-2024.

(Updates upcoming Indian inflation in the ninth and additional comment in 10th paragraph.)