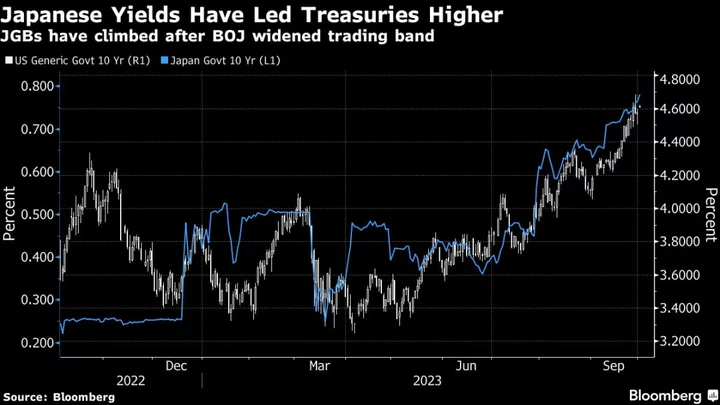

As Treasuries see their worst selloff in a year, a money manager says one catalyst to stop the rout will be the Bank of Japan coming out strongly to defend its yield curve control.

The Treasury rout is in part explained by moves in Japanese sovereign bonds, an anchor for global rates, said Adrian Janschek, who helps oversee A$10 billion ($6.5 billion) at First Sentier Investors in Sydney. If the BOJ stands firm when 10-year JGB yields reach its 1% limit, that will send a reassuring signal to investors everywhere, he said.

Investors want to “watch the Bank of Japan back the truck up and go: ‘it’s not going past 1%, we told you this,” Janschek said in an interview. “Everyone goes, okay, we’re up 4.70%, 4.80% in the US 10-year, let’s get in. I think that’s what needs to happen before people get really comfortable.”

Speculation that the BOJ, the last major central bank with negative rates, will turn hawkish has rippled through global bond markets. Traders fear that a potential end to Japan’s ultra-easy policy will tighten global liquidity while triggering a massive repatriation of Japanese funds from other parts of the world.

Benchmark 10-year Treasury yields surged 46 basis points in September, the biggest gain in a year, as Federal Reserve officials steadfastly cautioned interest rates will remain higher for longer amid a healthy US economy. They rose another five basis points to 4.62% on Monday.

Meanwhile, JGBs saw their biggest quarterly rout since 1998 as investors geared up for an eventual normalization by the central bank. While the BOJ stepped in on Friday with unscheduled bond purchases to slow the moves, the benchmark 10-year yield still rose one basis point on Monday to 0.775%.

BOJ Governor Kazuo Ueda has sought to tamp down speculation of a potential pivot during the central bank’s September meeting, as economists expect him to give way by the end of June given a revival in inflation and the yen’s weakness. Ueda at the weekend said there’s “still a distance to go” before the stance change.

While US yields are attractive, they will climb higher if Japanese bond yields head to 1%, Janschek said. “Certain things have to be put in place for the market to get confident about stepping in front of what looks to be a bit of a freight train,” he said.

Janschek said he isn’t buying Treasuries just yet as he awaits for the market to settle. His fund, which can make tactical trades outside Australia, exited its small position in 10-year Treasury futures in August.

It has returned 3.5% so far this year, compared with a benchmark of 2.8%, he said.