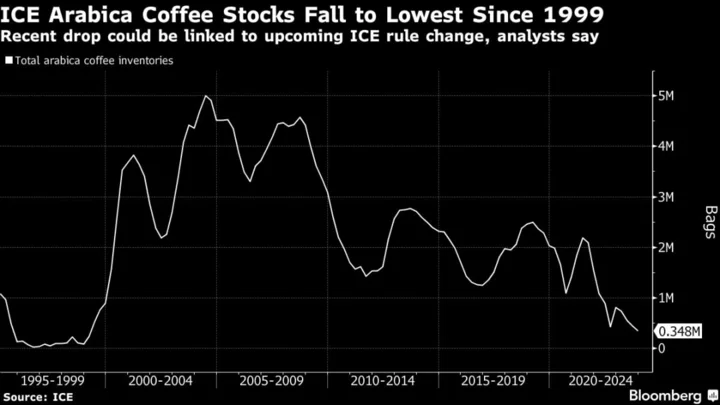

Stockpiles of premium coffee beans on the world’s biggest arabica exchange have plummeted to their lowest levels since 1999 as some sellers race to take advantage of a closing loophole one last time.

Although dropping inventories held in global warehouses monitored by Intercontinental Exchange Inc. would normally signal soaring demand or a crimp in supplies, the more than 20% plunge seen in the past month appears to be a strategic move ahead of a crucial Dec. 1 rule change.

For years, some sellers looking to avoid an “age penalty” meant to discourage lengthy coffee storage have pulled their older beans off the exchange and then resubmitted them for a new round of certification, thereby making the coffee appear fresh. That legal but misleading practice, which has led to roasters receiving older-than-expected beans and obscured the true volume of coffee in the market, will be prohibited as of next month.

“The only ones who have any incentive to take the coffee off the board and put it back are the owners,” Judy Ganes, president of J. Ganes Consulting, said of the recent drop in stockpiles. “The owners of the coffee know that they can stop the clock running on it and set the odometer back to zero” — but they only have until the end of the month to do it.

Coffee beans are certified to meet certain quality standards and are then held in exchange warehouses to be delivered to buyers of futures contracts. The exchange declined to comment.

Although there’s no way to know for sure why stockpiles are dropping without tracing each bag that leaves the warehouse, there’d be little fundamental reason for the drawdown. Physical coffee supplies are improving, with more arabica beans coming out of top producer Brazil after a bumper crop. The country exported almost 1 million bags more in October than it did in the previous month, according to preliminary data from exporter’s group Cecafe.

Many of the beans that were withdrawn from the exchange in the last few weeks are of Honduran origin and are known to be aged coffee, Ganes said, noting that they aren’t “heavily discounted” as would be expected. Anyone looking to buy the beans for roasting would likely pay for fresher beans instead.

It is “almost certain” that anybody holding certified coffee over this past month that could be recertified would do it, said Ryan Delany, the founder and chief analyst at Coffee Trading Academy. “Why would you leave money on the table?”

Traders had been expecting a rise in ICE inventories as Brazil’s crop arrived, not a further dip, Delany said. That has helped to spur a more than 15% rally in arabica futures prices over the last month, which could drive producing countries to start shipping more to exchange warehouses soon.

“With inventories as low as they are, the function of the market is to rally until it draws in new inventories, and so that’s what I would expect to happen,” Delany said.

--With assistance from Dayanne Sousa.