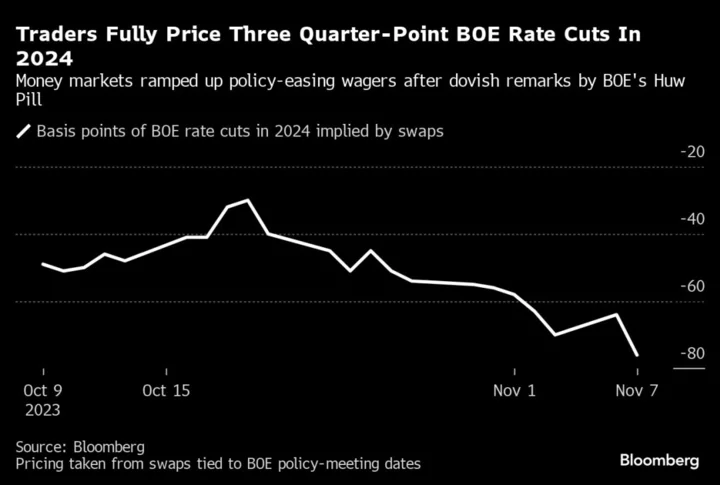

Traders moved to price in further interest rate cuts by the Bank of England next year, after a key policymaker hinted officials won’t push back against a market growing increasingly eager to position for a round of easing.

Pricing on Tuesday showed bets on 75 basis points of cuts next year for the first time, up from just 30 basis points last month. Swaps tied to policy-meeting dates show the first quarter-point decrease is expected in August, which BOE Chief Economist Huw Pill said “doesn’t seem totally unreasonable.”

Pill’s messaging, combined with his prediction that UK’s inflation rate will soon fall into line with that of other developed economies, was the first suggestion officials might be comfortable with the levels swaps are showing. That’s a green light for traders worried that Governor Andrew Bailey’s pledge last week to lean against building speculation over cuts meant the market was getting ahead of itself.

“We have been saying for a while now that we thought markets were not pricing in enough in the way of monetary policy easing,” said Paul Hollingsworth, chief European economist at BNP Paribas SA. He expects the BOE to lower interest rates by a quarter-point at every meeting starting in June, bringing the bank rate to 4% by the end of next year.

Traders will be closely watching a speech by Bailey on Wednesday, when he’ll have the chance to back Pill or reject his outlook.

Read More: BOE’s Bleak UK Outlook Lifts Bets on Sharp Rate Cuts in 2024

Even at 75 basis points, the scale of easing lags what’s expected from the US Federal Reserve and European Central Bank next year. Money markets point to almost a full percentage point from both after they kept rates on hold last month and broadly signaled that policy-tightening was at an end.

“We continue to think that this is still too shallow an easing cycle in 2024” in the UK, wrote Imogen Bachra, head of UK rates strategy at NatWest Markets. She anticipates a percentage point of cuts from the BOE next year.

The BOE’s new forecasts released last week show the inflation rate slowing to 4.8% in October as household energy bills fall. That would mark a sharp deceleration from 6.7% in September, but would still be faster than the latest prints seen in the US and eurozone at 3.7% and 2.9%, respectively.

Evelyne Gomez-Liechti, multi-asset strategist at Mizuho International Plc, says the BOE must balance between slowing economic activity and still-elevated inflation and wage growth. That means pricing more than 75 basis points of rate cuts “would look a bit stretched,” she said.