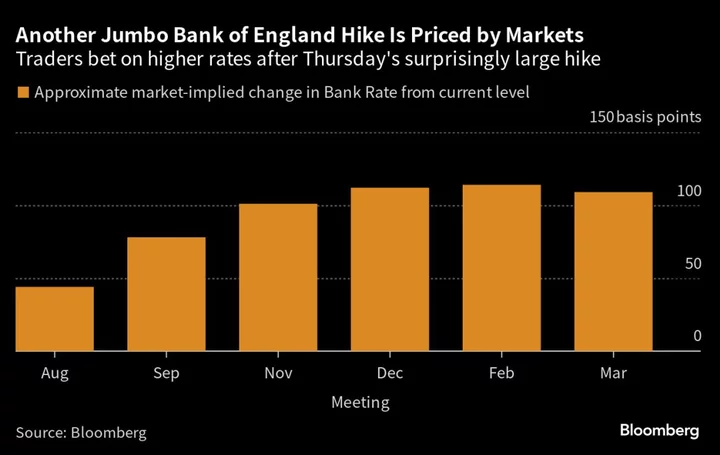

Traders are adding to bets that the Bank of England’s unexpectedly large interest-rate hike won’t be its last.

After the central bank defied economist and market forecasts by raising its benchmark interest rate by a half percentage point Thursday, traders quickly moved to bet on another such increase by September. Markets now see 75 basis points of tightening split over the next two meetings. Meanwhile, economists at Goldman Sachs Group Inc. revised their outlook, predicting a 50 basis-point hike in August.

The return to bigger hikes reflects concern among officials that the BOE’s tightening campaign — which began more than a year-and-a-half ago — is falling short. Inflation remains far above the central bank’s 2% target, with figures Wednesday showing consumer prices at 8.7% in May, the fourth consecutive month of faster-than-expected gains. That has the market expecting a more aggressive round of tightening, even if that puts the economy at risk.

“The BOE may have accepted that to achieve their inflation target, a recession may well be necessary,” said Jamie Niven, a fund manager at Candriam.

Certainly, a recession looks increasingly likely. Bloomberg Economics sees the UK entering a downturn if rates hit 6% — as markets already forecast — and experts are warning of a mortgage “time bomb” as those higher rates make it near impossible for households to refinance home loans.

Two-year mortgage rates have tripled to more than 6% since March 2022 but Prime Minister Rishi Sunak’s government has so far resisted calls to step in for fear of undermining the BOE.

“The UK finds itself in the worst position of major western economies,” said Joseph Little, global chief strategist at HSBC Asset Management. “A looming ‘mortgage squeeze’ and a turn in the credit cycle means that the economy now faces a recession as we head toward 2024.”

Pound Pain

That angst is evident not just in expectations for more hikes but also in the performance of the pound, which weakened following the BOE’s hike.

While higher rates would typically support the currency, fears around a hard landing saw the pound erase an initial jump, echoing a similar move after Wednesday’s inflation data. Bets in the options market are now the most bearish in almost five months versus the euro.

“It’s a classic EM style reaction,” Peter Kinsella, global head of FX strategy at UBP, said of the pound weakening and UK bond yields rising. “50 bps from the BOE reeks of pure panic.”

Policymakers led by Governor Andrew Bailey have raised rates by almost five percentage points since late 2021 and reiterated earlier guidance pointing toward higher rates in Thursday’s statement.

For Goldman Sachs economists, the half-point hike in the next meeting will be followed by a quarter-point move a month later, taking the bank rate to 5.75%. The bank’s previous forecast was for a quarter-point hike in August and a 5.5% terminal rate.

“Even if rates were to stay where they are in the next six to 12 months, that would be particularly restrictive on the UK economy,” said James Athey, investment director at Abrdn Investments, in an interview with Bloomberg TV on Thursday. “I think we will end up with a policy that will be pretty deleterious for the economy.”

--With assistance from James Hirai, Sujata Rao and Alice Atkins.

(Adds context and comments throughout.)