More than a dozen employees have left Shanghai-based copper traders affiliated with Chinese conglomerate Amer International Group Co. in the past few weeks, according to people familiar with the matter, in the latest sign of challenges facing one of China’s biggest private companies.

Amer, founded by billionaire copper tycoon Wang Wenyin, is China’s 38th largest company by revenue, according to the Fortune 500 ranking, and once boasted that it was responsible for 10% of the country’s copper imports. The exodus of staff — which includes some of the group’s top physical and derivative traders — highlights the strain in China’s metals sector, which has been hit by a lackluster recovery from the pandemic and a crackdown on trading at state companies.

The employees resigned from Amer’s trading affiliates including Shanghai-based China Copper Mineral Resources Co. They included some operational and financial managers in addition to traders, said the people, who asked not to be identified as the information is private. The companies, which for years have been major players in China’s copper market, have been downsizing their business, the people said, and are either unwinding or re-directing some of their long-term contracts.

Jiangsu Amer New Material Co., a listed unit of the company, fell by 1.3% as of 10:08 a.m. local time on Tuesday. The unit, a producer of fiber reinforced plastic, have lost about 42% so far this year.

The departures are mainly due to the challenging market conditions, four of the people said. Many market participants, including some of the largest banks, have stepped back from the Chinese metals trade in the past year amid low margins and some high-profile disputes — including the fall of Maike Metals International Co., once the country’s top copper trader.

Among Amer’s staff, anxiety has been further heightened by recent debt disputes that led courts to limit the personal expenditures of Amer’s chairman Wang, who is known in the local media as China’s “copper king,” twice in recent months. Both of the restrictions were lifted within one day after negotiations with creditors.

In an emailed response to Bloomberg News’ inquiry, Amer said the company’s business is being affected by severe international geopolitical uncertainties and the growing pressure on the global economy. Resignations are part of the regular flow of personnel, it said, adding that production and operational activities of the company continue as normal.

The company said the changes in the business structure of Amer’s companies in Shanghai is a response to economic and market conditions in China and internationally. It will continue to optimize in accordance with the market environment, according to the email.

Shenzen-based Amer was founded by Wang in the 1990s, and has long been on the Fortune Global 500 list of the world’s largest companies. It had annual revenue of $90.5 billion and profit of $1.5 billion last year, according to Fortune.

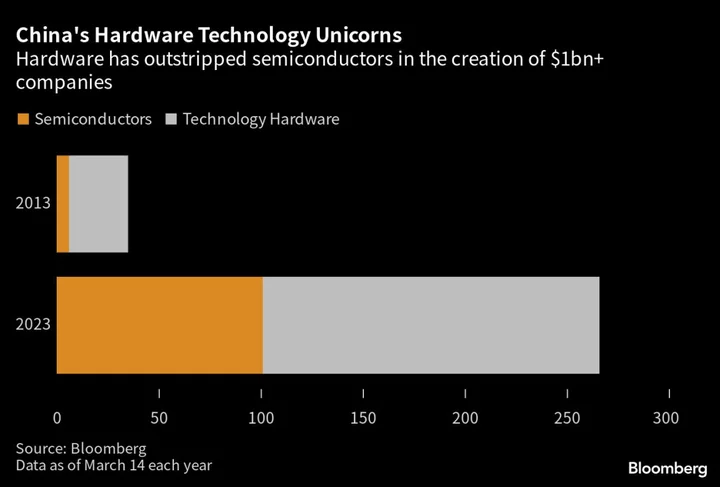

The group now owns mines and copper rod and wire manufacturing plants, as well as other investments that range from semiconductors to marble and jade, according to its website.

Still, its trading arm has been one of the main drivers of its revenues. In a rare interview in 2015, a top official at an Amer trading unit in Shanghai told Bloomberg that the company handled about one tenth of China’s copper imports.

(Updates with share price performance in fourth paragraph)