BANGKOK (AP) — World shares were mixed Wednesday after Wall Street benchmarks retreated following the S&P 500’s rise to its highest level since the spring of last year.

London, Paris, Hong Kong and Shanghai declined while Tokyo and Frankfurt edged higher. U.S. futures and oil prices slipped.

This week has few potentially market-moving events.

Investors are awaiting congressional testimony by Federal Reserve Chair Jerome Powell this week. Market players worry the the Fed may have to keep rates higher for longer, which would pressure the economy and potentially bring on a recession.

The Bank of England will meet on interest-rate policy Thursday. Central banks around the world are heading in diverging directions as they battle inflation amid worries about a pressured global economy.

Germany's DAX edged 0.1% higher to 16,121.68 and the CAC 40 in Paris slipped 0.1% to 7,284.01. Britain's FTSE 100 also fell 0.1%, to 7,562.54.

The futures for the Dow Jones Industrial Average and the S&P 500 fell less than 0.1%.

On Tuesday, the U.S. stock market took a step back after rising on hopes the economy can avoid a recession. The S&P 500 fell 0.5%, while the Dow lost 0.7% and the Nasdaq composite gave back 0.2%.

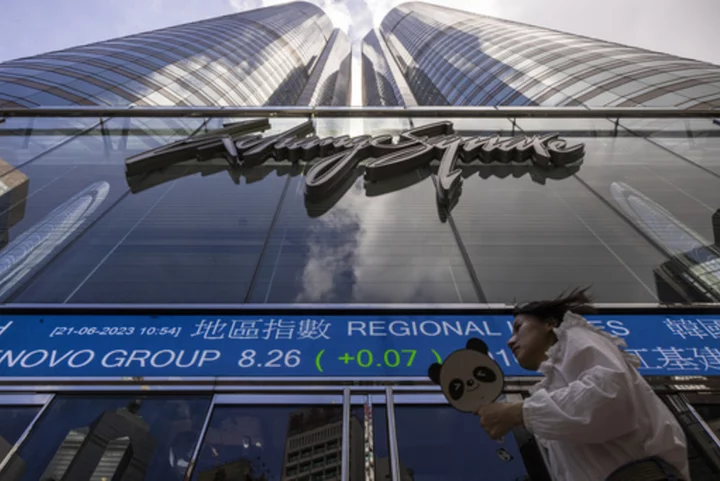

Wednesday in Asia, Tokyo's Nikkei 225 advanced 0.3% to 33,575.14, while the Hang Seng in Hong Kong sank 2% to 19,218.35. The Shanghai Composite index gave up 1.3% to 3,197.90 and the Kospi in Seoul slipped 0.9% to 2,582.63.

In Australia, the S&P/ASX 200 shed 0.6% to 7,314.90. Bangkok's SET lost 1.1%, while India's Sensex was up 0.3%.

Powell will testify before Congress on Wednesday and Thursday. Last week, the Fed held its benchmark lending rate steady, the first time in more than a year that it didn’t announce an increase. But it also warned it could raise rates twice more this year.

“Investors are turning cautious ahead of another hefty dose of Fedspeak amidst a relatively light data docket,” Stephen Innes of SPI Asset Management said in a commentary.

He added that “with central banks in the mood to dish out inflation pain these days, investors may need to see some positive inflation data convergence to narrow the wide disparity between the Federal Reserve and the market’s forward inflation expectations before breaking fresh higher ground on U.S. stocks.”

Markets have been buoyed by speculation that inflation is easing enough for the Fed to stop raising interest rates soon. A frenzy around artificial intelligence has also vaulted a select group of tech stocks to huge gains.

Those hopes are battling against worries that the Fed will keep interest rates high for longer, which could grind down the economy. Some of the easiest improvements in year-over-year inflation will soon be passed, bringing tougher times for both the economy and financial markets.

During the 70s, inflation remained high for much longer than hoped, forcing the Fed to ultimately drive the economy into a painful recession.

In other trading Wednesday, U.S. benchmark crude oil gave up early gains, falling 13 cents to $71.06 per barrel in electronic trading on the New York Mercantile Exchange. It gave up 74 cents to $71.19 per barrel on Tuesday.

Brent crude, the international standard, lost 20 cents to $75.70 per barrel.

The dollar rose to 141.90 Japanese yen from 141.43 yen. The euro was trading at $1.0926, up from $1.0922.