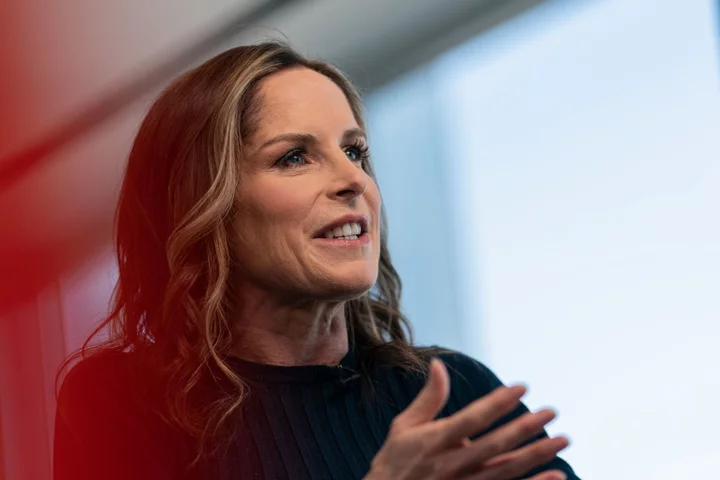

Dawn Fitzpatrick, chief investment officer of Soros Fund Management, said she expects more US banks to fail and that smaller lenders are particularly vulnerable.

“There’s more problems under the surface,” she said Wednesday at the Bloomberg Invest conference in New York.

Several regional US banks have collapsed this year after failing to prepare for the Federal Reserve’s aggressive monetary tightening following years of near-zero rates. Depositors fled the banks en masse, moving their money to larger firms that have been deemed “too big to fail.”

Regulators have auctioned off sizable portfolios in the wake of the failures, which is “adding to the technical backdrop,” Fitzpatrick said.

Fitzpatrick also said agency mortgage-backed securities present a uniquely interesting investing opportunity.

“Two-thirds of your current holders — it’s central banks and banks — have turned into sellers,” she said. “The valuations in that space have gotten disproportionately cheap relative to other asset classes.”

On Tuesday, Pacific Investment Management Co. CIO Dan Ivascyn said that agency mortgage-backed securities are the “most attractive asset.”

Read More: Pimco Sees Best Bond Return Potential in 14 Years as Rates Rise

--With assistance from Erik Schatzker.