With the final quarter of 2023 approaching, one winning strategy in emerging markets is becoming clearer: buying shares in smaller companies.

The trade has produced an extra gain of 12 percentage points over the MSCI large-cap index so far this year, on course for the second-best relative returns in the past 14 years. Part of the reason is that large-cap companies are more likely to be exposed to China’s economic troubles.

Small-caps, on the other hand, are benefiting from local growth stories such as India’s as well as the craze for investing in young companies in artificial intelligence and electric vehicles.

“Small caps in EM have rallied relative to the large caps since the end of the Covid drawdown, in line with previous historical instances when small outperforms large coming out of recessions,” said Jitania Kandhari, deputy chief investment officer at Morgan Stanley Investment Management, which has more than $1 trillion in assets under management. “Strong domestic recovery cycles drove the initial outperformance and the underperformance of the mega-caps has driven it further.

The MSCI Emerging Markets Small Cap Index, which includes 1,905 stocks with an average market value of $583 million, is up 14.7% so far this year. That compares with a 2.5% gain in its large-cap counterpart, where the average size is $7.9 billion.

Growth Stories

Individual small stocks are producing some impressive returns: Taiwan’s Wistron Corp. and Global Unichip Corp. have soared 255% and 131% respectively this year, on the back of their links with artificial intelligence development. Stocks like Jindal Stainless Ltd. and Rail Vikas Nigam Ltd. are at least 100% higher, riding India’s economic growth, the fastest among major economies.

South Korea’s Ecopro BM Co. notched the best gains on the Bloomberg Electric Vehicles Index, up 204%. Brazilian education company Yduqs Participacoes SA has soared 103%, rewarding investors who had bet on its turnaround from a post-Covid slump with an emphasis on digital revenue.

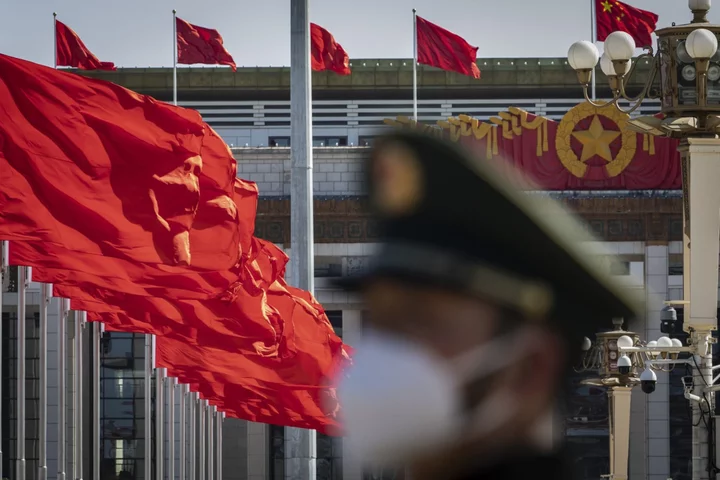

China dominates the large-cap index with 375 entries, well over half the total. That means drops in large Chinese companies including Meituan, down 29% this year, and JD.com Inc., down 43%, pull the entire index down. India’s Adani Group companies, too, weighed on the gauge after a short seller’s report alleged governance and transparency issues.

“The outperformance of small caps in emerging markets over large caps is more explained by the country skew,” said Ashish Chugh, a money manager at Loomis Sayles & Co. Portfolios that went underweight China and prioritized India, Taiwan and Korea would have done well in either category, he said.

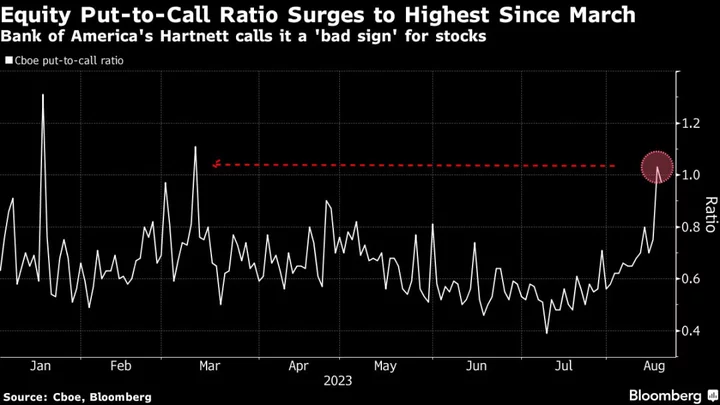

But sky-high returns also mean enhanced risk for investors. Emerging-market small caps are notoriously volatile and are the first to be sold off when risk sentiment sours. They handed investors deep losses during the 2000 dot-com bust, 2008 financial crisis and 2018 US-China trade war, with the MSCI small-cap index underperforming its large-cap peer by about 30% on each of those occasions.

Lower levels of regulation, political interference and governance issues dog the small-cap sector. Even in large economies like India, such stocks are the target of market manipulators, leaving retail shareholders with dud investments.

For small-cap stocks with a sound management and business plan, the next boost may come from central banks that are preparing to cut interest rates. A new growth cycle can extend their outperformance and counter investors’ concern over the impact of China’s slowdown on larger stocks, said Nenad Dinic, an equities strategist at Bank Julius Baer in Zurich.

“The backdrop of lower borrowing costs benefits small caps significantly, as they often rely more heavily on debt financing than large-cap counterparts,” Dinic said.

What to Watch

- In a week packed with economic data and interest-rate decisions, investors will look for clues that policymakers are doing enough to contain inflation and accelerate growth

- China will announce its decision on the prime lending rate; forecasts are for no change, but traders will seek signals the nation will continue to provide stimulus to come out of a deflationary spiral

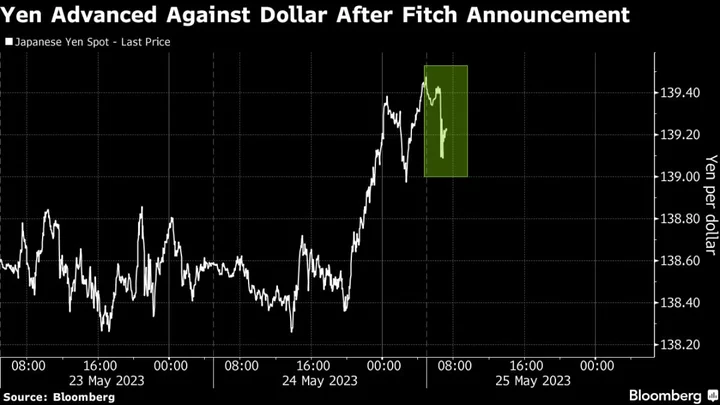

- Turkey, which has adopted market-friendly policies under President Recep Tayyip Erdogan’s new term, may raise rates by 5 percentage points to 30%; the country’s reaffirmation of rates orthodoxy could buoy the nation’s assets further

- Rate decisions are also due from Taiwan, Indonesia, South Africa and Brazil

- Mexico will publish inflation, retail sales and economic activity data

- Argentina will release data on economic growth, trade and budget balance