Infrastructure developer Morrison & Co. has begun talks with possible strategic partners for a mega-sized battery project in Indonesia aimed at weaning Singapore off natural gas.

The New Zealand-based fund has hired advisers for discussions it hopes to close in the next 12 months for partners with experience in the region to take a stake in its multibillion-dollar Vanda RE project, Vimal Vallabh, Morrison’s global head of energy, said in an interview in Sydney.

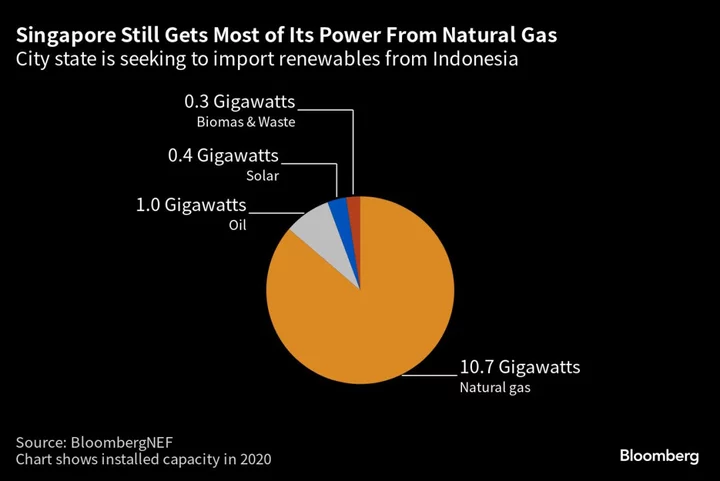

The venture between Morrison’s Gurin Energy Pte Ltd. and a unit of Malaysia’s Petronas Nasional Bhd. is one of five developments that last month won approval to supply Singapore with 2 gigawatts of renewable energy from Indonesia. The city-state is seeking to import 4 gigawatts of renewables by 2035 — or about a third of its current, mainly gas-fired capacity — as part of its emissions-reduction plans.

Vanda RE is still finalizing the exact technologies it will use, but requires at least a 2-gigawatt solar plant and a 4.5 gigawatt-hour battery, said Vallabh, who’s also chairman of Gurin. Gurin is only offering part of its own 75% stake in the venture, he said.

That capacity would make the battery larger than any currently operating, although smaller than others at more advanced stages of development, BloombergNEF data show.

“People talk about it being fanciful just because of the size of the project, but my first wind farm project was 30 megawatts in 2003, and that was big,” Vallabh said. “Today we’re doing 500 megawatts or gigawatts — it’s just evolution.”

Singapore is aiming to decarbonize its power mix but faces limits on building solar and wind farms because of its lack of available space. Authorities aim instead to import about 30% of electricity by 2035, and in March also gave conditional approval to get 1 gigawatt of renewable capacity from Cambodia.

Infratil, the Morrison-backed company behind Gurin, said in September that Vanda would not require any specific financial commitment from Infratil.