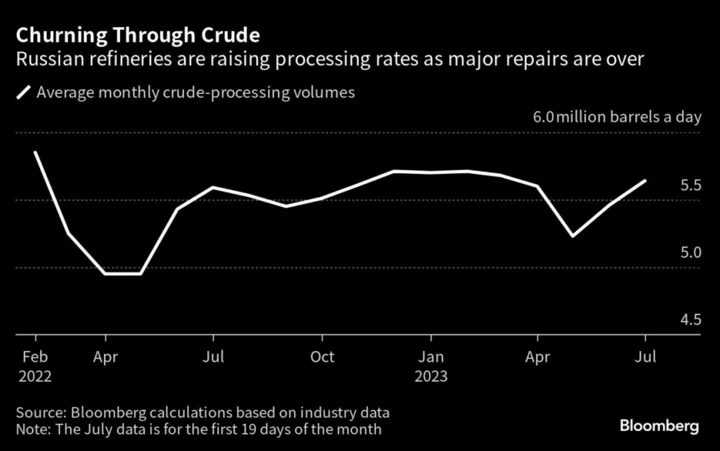

Russia’s weekly refining runs declined for the first time since late June amid repair works at smaller facilities.

The nation’s primary processing rates averaged 5.6 million barrels a day in the week to July 19, according to a person with knowledge of the matter. That’s down about 78,000 barrels a day from the period before and the first drop in three weeks, Bloomberg calculations show.

The decline is due to planned works at Gazprom’s Surgut condensate-processing plant, maintenance at the Yayskiy refinery in western Siberia, and lower runs at Rosneft PJSC’s Angarsk refinery, according to Mikhail Turukalov, an independent US-based oil analyst.

Still, average crude-processing for the month through July 19 was 5.64 million barrels per day, up from roughly same period in June, when Russian refineries processed an average 5.46 million barrels per day, historical data show.

Crude supplies to Russia’s refineries and seaborne exports are the most closely monitored indicators of the country’s production since the government started keeping industry statistics under wraps. Oil watchers are following the two datasets to gauge Moscow’s compliance with a pledge to reduce output by 500,000 barrels a day from February levels.

Last week’s drop isn’t necessarily indicative of Russian producers changing their strategy of maximizing refinery runs, said Viktor Kurilov, senior oil markets analyst at consultancy Rystad Energy. Longer-term monitoring is required to determine if the nation’s oil-processing rates will continue to drop, he said.

Earlier this year, during the spring maintenance season, Russian oil firms hiked exports as their refineries reduced processing.

Read more: Russia Finally Cuts Crude Exports, at Most Opportune Moment

Last week’s decline in refinery runs didn’t lead to a hike in Russia’s seaborne exports, according to data from market intelligence firm Kpler Ltd. In the week to July 17, the nation shipped some 3.16 million barrels a day from its sea ports, versus 3.27 million the week prior.

“I expect Russian producers to retain high processing volumes by redirecting barrels from exports until at least the second half of August, when the new maintenance season starts,” said Viktor Katona, Kpler’s head crude analyst.

“Potentially, some major oil firms may even push the maintenance further back to take advantage of the last weeks of full-scale downstream subsidies,” which are set to be halved from September, he added.