Asian and European oil buyers are having to pay hefty prices for lower-quality, dirtier crudes as sanctions on Russia and OPEC+ output cuts reduce the availability of those grades.

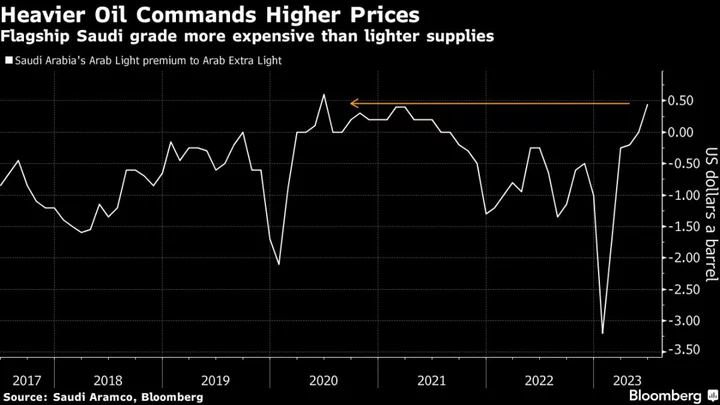

The shift has taken traders by surprise, as less-dense, or light, crude is usually more expensive since it’s easier to process into higher-value fuels and requires less costly sulfur removal.

In a rare move, Saudi Aramco will sell its Arab Extra Light variety for less than Arab Light to Asia next month. And the price gap between two of Abu Dhabi’s most widely traded varieties, which are different in terms of quality, has also narrowed sharply this month.

An embargo on Russia’s flagship Urals oil and disruption to flows from Iraqi Kurdistan have contributed to the unusual situation by boosting prices of medium sour grades. New refineries in the Middle East, mainly in Kuwait and Saudi Arabia, have also been ramping up and taking more feedstock, adding to the tightness for these varieties.

In contrast, the supply of lighter crude has been more robust, with barrels continuing to flow from producers in the US, Kazakhstan and even Africa.

Those factors have weighed particularly on grades like Abu Dhabi’s Murban crude, for which sellers have slashed spot premiums to make it competitive, according to traders who buy and sell those barrels.

Murban for July loading is being discussed at a premium of about $1.70 a barrel to the Dubai benchmark, while the heavier, more sulfurous Upper Zakum grade is only marginally cheaper at $1.60 above the same marker, traders said. Omani crude, also heavier than Murban, is trading about $1.50 above Dubai, they added.

Demand for Murban has also ebbed as profits from turning crude into diesel tumbled, which has contributed to some Asian refiners considering cuts to processing rates. The grade is used to produce a lot of the industrial and transport fuel.

(Adds detail on the ramp-up of Middle Eastern refineries in fourth paragraph.)