Traders who drove the pound to its best week of the year have a lot riding on the next inflation report, where even a faster-than-expected rate could work against them.

Pricing in the options market suggests investors are already revving up to sell, concerned that something in the economy will eventually break under the weight of ever-higher rates. Positioning is also looking stretched as traders trim the most-bullish wagers in half a decade.

For months, investors have been piling in to lock in juicer returns as accelerating inflation forced the Bank of England to push ahead with its most aggressive tightening drive in a generation. The UK currency rose from a record low in September, to end the week near $1.30.

But the worry is the pound will suffer regardless of how lofty the rate is. And the numbers on Wednesday may mark the point where sterling bulls capitulate.

“Elevated levels of inflation coupled with weaker growth is not necessarily a positive for the currency even if interest rates are going up,” said David Adams, head of G10 FX strategy at Morgan Stanley in London.

UK inflation came in stronger than expected in each of the past four months, fueling wagers the Bank of England would have to keep raising rates faster than its developed-nation peers. Bets on the BOE’s peak rate hit 6.5% at one point — the highest in 25 years and well above investors’ expectations for how high the Federal Reserve will push US borrowing costs.

Bearish Positioning

Since then, US inflation came in below forecasts, bolstering the case for an even slower pace of increases. Yet currency strategists and market positioning show pressure building for the pound to go into retreat regardless.

Nomura Holdings Inc. sees the euro climbing almost 3% against the pound to 0.88 by the end of September, while Morgan Stanley envisages a 6% gain for the common currency by mid-2024.

Monex USA, the most accurate predictor of the pound’s moves against the greenback in Bloomberg’s second-quarter poll, sees the pound slipping back to $1.29 by the end of the year. JPMorgan Chase & Co. says it will be around 9% weaker at $1.19 by year-end.

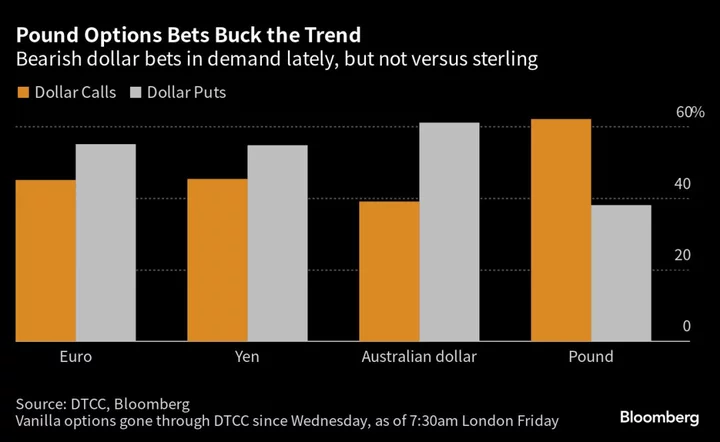

And while last week’s slowdown in US inflation boosted appetite for options to sell the dollar against most currencies, many traders avoided dumping it for the pound, according to DTCC. What’s more, speculative traders have begun to trim bullish wagers on sterling after extending them to the strongest in more than five years in the run up to the last BOE meeting in June, the CFTC data show.

Read more: Rising UK Rates Are Turning Into Threat for Banks: Taking Stock

“We’re starting to see the hedge fund community thinking about the weaker pound because now it’s very stretched,” said Carlos Fernandez-Aller, head of Global FX and EM markets macro trading at Bank of America. “But we all got the weak pound trade wrong earlier in the year, so we’ll see.”

Even if the Wednesday numbers show inflation starting to come off, it remains at levels last seen in the 1980s, which will require the BOE to keep hiking, according to Michael Cahill, FX strategist at Goldman Sachs, who sees the pound up about 1.4% at $1.33 in 12 months’ time.

“The UK has the highest nominal rates in the G-10, but also the lowest real rates in the G-10,” he said. “We’ve got still very strong inflation and wages. It calls pretty clearly for tight policy and that should benefit the currency.”

Still, slowing inflation would shift the conversation in economic circles away from the doom loop of a wage-price spiral feeding higher interest rates that make a recession inevitable. According to MUFG strategists in London, that would give markets a more traditional reason to curb the pound rally.

“The scale of tightening priced into the UK curve reflects the much worse inflation backdrop,” They said. “But the speed of turnaround in the US inflation risks does serve as a possible example of what could unfold here.”

--With assistance from Alice Atkins, Vassilis Karamanis and Reed Landberg.