This morning’s news deluge offers good occasion to think about lunch early: Wagamama owner The Restaurant Group Plc said Wheel Topco, which owns PizzaExpress, has asked the company for information so it can evaluate a possible takeover offer.

Any bid would rival US private equity giant Apollo Global Management, which earlier this month struck a surprise deal to buy Restaurant Group for about £500 million.

What’s your take? Ping me on X or drop me an email at lkehnscherpe@bloomberg.net.

Key Business News

WPP Plc: The advertising giant slashed its outlook for revenue growth after reporting sluggish sales to clients in the technology industry and China.

Unilever Plc ruled out any major acquisitions as new Chief Executive Officer Hein Schumacher set out a strategy that includes overhauling management and focusing on its biggest brands.

- Unilever’s third-quarter sales rose 5.2%, just missing expectations, as price rises for products like Hellmann’s mayonnaise and Sure deodorant eased. Volumes were dragged down by ice cream.

Heathrow Airport: Europe’s largest travel hub expects 2024 traffic to be in line with 2019 and boosted its adjusted Ebitda forecast for 2023 to £2.2 billion. Still, it doesn’t expect to pay any dividends for this year.

Standard Chartered Plc’s profit missed estimates in the third quarter as the lender took a $186 million charge on Chinese real estate and an impairment of $700 million on China Bohai Bank, reflecting the uncertain trajectory of Asia’s biggest economy.

Markets Today’s Take

The evidence is piling up that the advertising industry, particularly in the US, is struggling. WPP has cut its outlook for the second time this year, following from a similar warning given by US peer Interpublic last week. Both said their performance is being slammed by lower spending by big technology companies.

Sentiment won’t be helped by the caution flowing from Meta Platforms, Facebook’s parent company. It said any long-term recovery in the advertising industry will be at the mercy of an uncertain macroeconomic outlook. Those comments sent its shares lower in after-hours trading in New York.

— Sam Unsted

For more news and analysis throughout the day, follow Bloomberg UK’s Markets Today blog.

What’s Next?

Results from British Airways owner IAG SA and lender NatWest Group Plc will be in focus tomorrow morning.

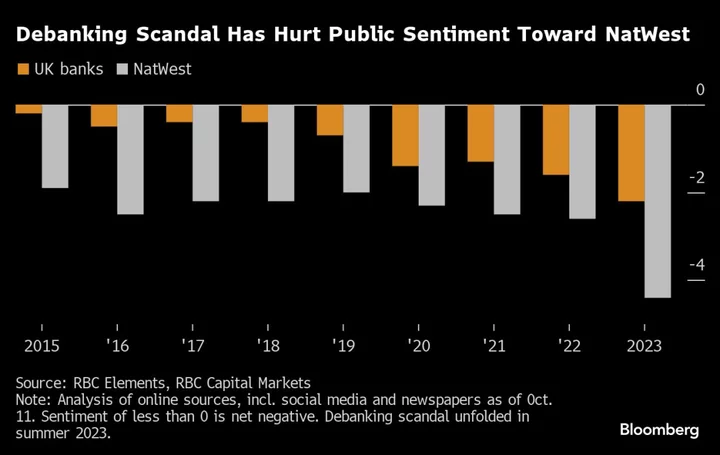

Beyond plain numbers, NatWest’s executives will surely be quizzed about their hunt for a permanent chief executive officer following Alison Rose’s abrupt departure this summer over the debanking controversy. The UK’s top data watchdog yesterday concluded that Rose breached data protection laws when she discussed the closure of Nigel Farage’s bank account with a reporter.