The Philippine central bank will likely keep its benchmark interest rate unchanged after an out-of-cycle increase three weeks ago gave it scope to sit back while weighing price and currency risks.

Seventeen out of 22 economists in a Bloomberg survey expect the Bangko Sentral ng Pilipinas to hold its target reverse repurchase rate at 6.5% on Thursday, after an unscheduled quarter-point increase on Oct. 26. The rest see another 25-basis-point hike to 6.75%.

A pause would signal that the recent wave of monetary tightening in parts of Asia could well be short-lived. With the Federal Reserve predicted to be done with raising rates, emerging-market currencies have regained strength. Global oil prices have also cooled as fears of a broader Middle East conflict ease.

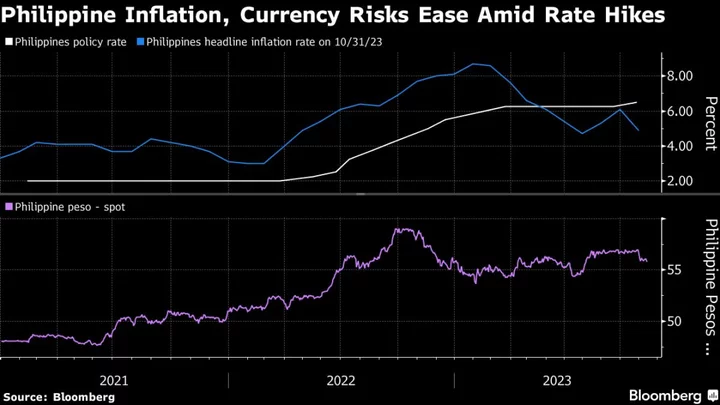

A separate Bloomberg poll shows majority of analysts see the BSP standing pat at 6.5% — the highest in 16 years — through mid-2024. Despite raising their annual forecasts, economists still expect inflation to return to within the central bank’s 2%-4% target by next year — at 3.7% in 2024 and 3.3% in 2025 — from an estimated 6% average this year.

“After an off-cycle hike, the Bangko Sentral ng Pilipinas can catch its breath,” HSBC Holdings Plc. economist Aris Dacanay said, adding that there is “no urgent need” to raise the policy rate again after price gains slowed in October and the peso returned to the 55-level against the dollar this month.

Policymakers will likely remain hawkish in tone, wary of price risks still tilted to the upside. “Keeping the tightening line open will therefore be a strong signal by the BSP of its commitment to bring inflation back to target,” Dacanay said.

Here’s what to watch out for on Thursday at 3 p.m. local time:

Inflation Outlook

Investors will be keen to know whether October’s lower-than-expected inflation print of 4.9% was a one-off or the start of a sustained downtrend that could keep the central bank from taking further action. The BSP has flagged higher power and transport costs while adverse El Nino weather could also pose risks to the inflation path and dislodge expectations.

Last month’s rate hike “provides some cushion should inflation surprise on the upside again,” giving policymakers room to wait for the next price prints before deciding its next move, according to Bank of the Philippine Islands economist Emilio Neri.

Sustaining Growth

The Philippines’ third-quarter gross domestic product growth stunned the market, coming in at 5.9% and beating the 4.7% estimate. Still, details of the GDP report showed that consumption and capital formation grew at their slowest pace in a decade, outside of the pandemic years.

That could stay BSP’s hand, especially as the economic impact of its most aggressive tightening cycle in two decades — totaling 450 basis points since May 2022 — will continue to be felt. As it stands, higher borrowing costs are discouraging investment while elevated prices and stabilizing remittances dampen household spending, according to Debalika Sarkar and Sanjay Mathur, economists at Australia & New Zealand Banking Group Ltd.

A Bloomberg poll showed economists maintained their 2023 GDP expansion estimate at 5.3% — below the government’s 6%-7% target — while revising down their 2024 growth outlook to 5.6% from 5.7%.

Peso Stability

With the Fed rate looking more and more likely to have peaked, pressure on currencies has eased. The peso has regained about 1.6% so far this month. The reprieve may be temporary, according to Bloomberg Economics’ Tamara Mast Henderson.

Higher-for-longer rates and increasing signals of a recession in the US, along with worsening geopolitical tensions in the Middle East, Europe and the South China Sea are a potential driver of capital outflows in the region, she said. Sub-par economic growth in the Philippines will be a threat to the peso, she added.

--With assistance from Tomoko Sato and Cynthia Li.