China’s central bank said it has sufficient policy space to support the economy’s recovery, adding to expectations there could be more easing to come — including interest rate cuts — after this month’s pause.

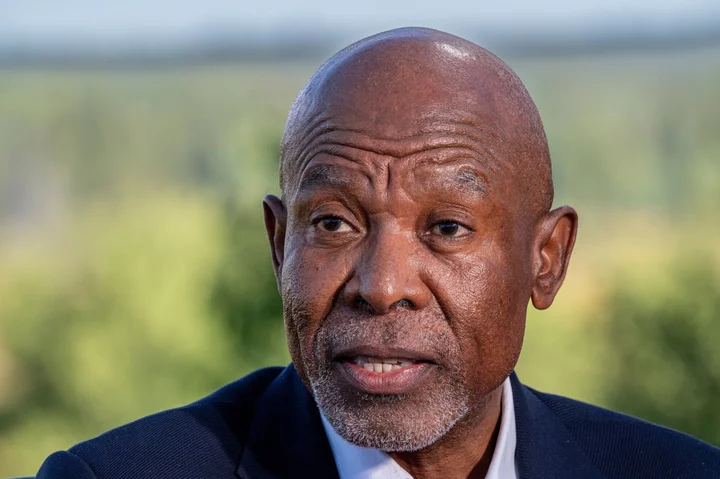

The People’s Bank of China has “ample policy room” to react to challenges, Zou Lan, head of the monetary policy department at the People’s Bank of China, told reporters at a briefing in Beijing on Wednesday. The central bank will step up counter-cyclical adjustment, he said, reiterating the PBOC’s previous policy stance.

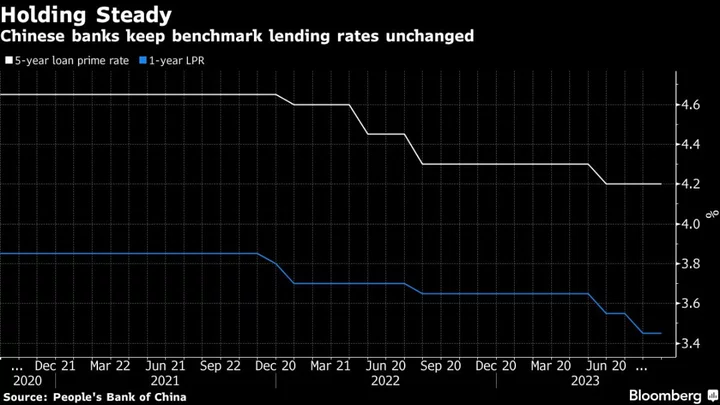

The comments came shortly after Chinese banks left their benchmark loan rates unchanged, in line with the PBOC’s pause last week. Economists expect policymakers to add more stimulus, though, since the economy’s recovery remains fragile despite showing some early signs of stabilizing.

“We see chance for further relaxation and stimulus measures in the month ahead,” said Wee Khoon Chong, a senior market strategist at Bank of New York Mellon in Hong Kong. “We don’t rule out a rate cut, but for choice, we see fiscal expansion to have greater impact than rate cut.”

Local stocks retreated on Wednesday, with a gauge of Chinese shares listed in Hong Kong closing 0.9% lower. The yield on 10-year government bonds was flat at 2.68% and the onshore yuan was little changed at 7.2992 per dollar as of 4:13 p.m. local time.

Officials from the National Development and Reform Commission and the Ministry of Finance also attended the briefing on Wednesday, pledging to improve local government finances and step up policy action to achieve economic goals this year.

The PBOC may be waiting to see the economic effects of its previous easing measures, including policy interest rate cuts in August and a reduction in the reserve requirement ratio for banks last week.

Yuan Pressure

Policymakers are also wary of putting further downward pressure on the yuan ahead of the US Federal Reserve’s next rate decision. The Fed is expected to hold rates later Wednesday while still signaling room for another hike this year. The widening rate gap between China and the US has fueled capital outflows, driving the yuan down.

The PBOC’s Zou warned against currency speculation, adding that the economy’s recovery means the yuan will stabilize.

“We will firmly crack down on behaviors that disrupt the market order and firmly prevent risks of excessive adjustments in the yuan,” Zou said. “With the continued recovery of the Chinese economy, there is solid foundation for the yuan’s exchange rate to stay basically stable at an equilibrium level.”

Chinese state media still see scope for more easing. The Shanghai Securities News cited analysts in a front-page report on Wednesday saying there’s room for the PBOC to further cut the RRR for banks and lower interest rates this year to shore up the country’s economy.

The loan prime rates are based on the interest rates that 18 banks offer their best customers, and are published by the PBOC monthly. They are quoted as a spread over the central bank’s one-year policy rate, or the medium-term lending facility rate, which was kept unchanged last week.

Policy Effectiveness

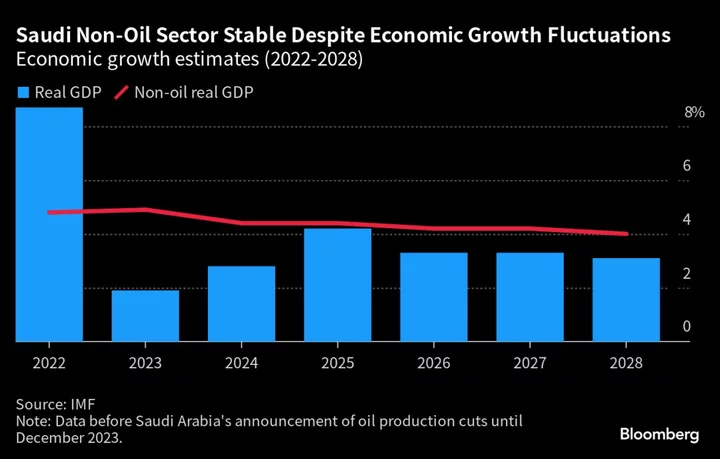

Chinese authorities will focus on expanding domestic demand, boosting confidence and preventing risks to achieve its 2023 growth target, said Cong Liang, a vice chairman of the National Development and Reform Commission. Beijing had set a relatively conservative growth target of around 5% for this year.

“There’s quite a lot of noise about the prospect of shorting China, both within and outside the country,” Cong said. “Such forecasts were never realized in the past and will not be materialized in future,” he said, adding that macroeconomic policies introduced so far have been “effective.”

China’s consumer inflation rebounded above zero in August after falling into deflation territory in the previous month. Cong said prices should keep recovering as demand and confidence pick up gradually and last year’s comparison base comes down.

At Wednesday’s briefing, finance ministry officials also said that Beijing is trying to contain debt risks by beefing up monitoring of local finances. Mounting local government debt has grown as a threat to China’s financial and economic stability as pandemic controls and the property downturn squeezed regional incomes.

Absent massive fiscal stimulus this year, one way for Beijing to support regional authorities is via transfer payments, given the central government’s finances are in better shape. Beijing outlaid 9.55 trillion yuan ($1.3 trillion) in transfer payments to local authorities in the first eight months of 2023, according to Li Xianzhong, head of the finance ministry’s treasury department. That’s 95% of the amount budgeted for the year.

Separately, Li said that local governments have sold 2.95 trillion yuan worth of special bonds through the January-August period, or 77.5% of the annual allowance. Such bonds are typically used to finance infrastructure spending, a big driver of economic growth. Much of this year’s quote has favored economically strong provinces, particularly those heavy in manufacturing, Li said.

--With assistance from Iris Ouyang and Qizi Sun.

(Updates with more details from briefing. A previous version of the story corrected the name of the state-run newspaper.)