The recent pullback in US stocks has further to go, according to Wall Street’s most bullish strategist.

“Bullishness is relatively high while the Fed remains shy of its inflation target,” said Oppenheimer & Co.’s chief investment strategist John Stoltzfus wrote in a note to clients. He said investors should curb their enthusiasm for a long rate pause or even a rate cut and instead “right-size expectations.”

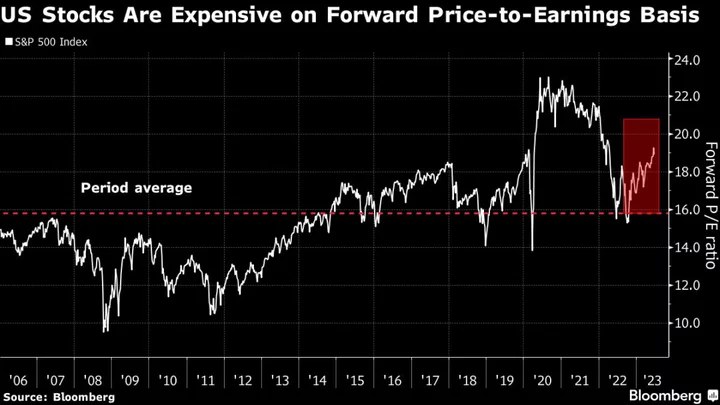

Lingering concerns that a strong economy will prompt the US Federal Reserve to hold interest rates higher for longer has been weighing on stocks, with the US benchmark sliding 3% since a peak in late July. A buzz around artificial intelligence has been boosting the S&P 500 Index for most of this year, ignoring risks from rates and a potential economic slowdown.

Read more: S&P’s Path to 5,000 Needs a Soft Landing Into 2024: Surveillance

“We could see some choppiness near term,” said Stoltzfus, who lifted his target on the S&P 500 to 4,900 points in late July, the most bullish call among strategists surveyed by Bloomberg. Since then, the US benchmark has been under pressure.

Stoltzfus’ peers at Deutsche Bank AG also see a “modest extension of the current pullback.” Citing historical data, strategists including Parag Thatte and Bankim Chadha said modest equity pullbacks of 3%-5% typically occur every two to three months.

Meanwhile, Goldman Sachs Gropup Inc. strategist David Kostin is more positive on the prospects of a soft landing of the US economy and sees the S&P 500 index climbing to 4,700 in the next 12 months. Morgan Stanley’s Michael Wilson disagrees, saying US stock investors are in for disappointment as economic growth is set to be weaker than expected this year.

--With assistance from Michael Msika.