Homebuyers are getting the edge in the UK property market, forcing the growing ranks of sellers to slash prices in order to secure deals.

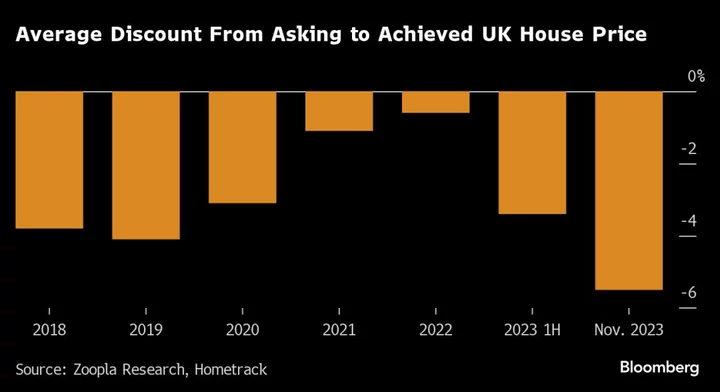

The gap between asking prices and the values achieved at sale rose to a five-year high of 5.5% in the first half of November, with one in four deals involving a reduction of more than 10%, according to property portal Zoopla. The number of homes for sale per UK estate agency branch rose more than a third year-on-year to 31, the highest in six years.

“There is evidence of greater realism amongst sellers on pricing with a growing acceptance that what a home might have been worth a year ago is now largely academic given current market conditions,” said Richard Donnell, executive director at Zoopla.

Read more: Higher-for-Longer Rates Are Crushing Global Real Estate Markets

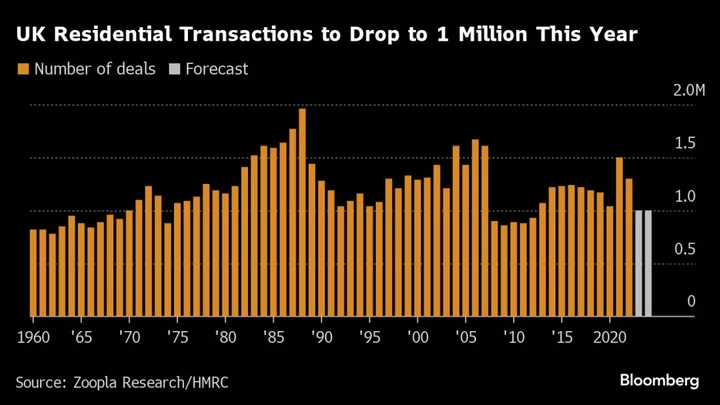

UK households are facing a stream of pressures triggered by monetary tightening and a cost-of-living crisis that’s pricing many out of buying a property. As average mortgage rates linger close to 6%, the pipeline of agreed home deals is languishing at its lowest level in four years, according to Zoopla.

Buyers are getting the best discounts in southern England, where the average agreed reduction to asking price is 6.1% across London and the south east. What’s more, a steady return to the office is supporting transaction levels in the capital, where sales volumes have rebounded more than any other part of the UK in the last two months.

Zoopla said repricing has further to run in 2024, with higher mortgage costs meaning prices must decline to make repayments affordable. Only homeowners pricing their properties realistically are likely to attract demand next year, especially as supply increases, the report said.

Read more: Billionaires Eye Renting in London as Interest Rates Dent Buying

To be sure, the drop in home values so far remains modest, with the average UK house price declining 1.2% over the past year, according to Zoopla. Higher earnings are slowly improving buying power, which should boost demand toward the end of 2024 — particularly if the Bank of England starts cutting rates.

“These are the best conditions for homebuyers for some years with more homes to choose from and with sellers more prepared to negotiate on price to agree a sale,” Zoopla’s Donnell said. “Sellers have plenty of room to negotiate with average house prices still £41,350 ($52,221) higher than the start of the pandemic.”