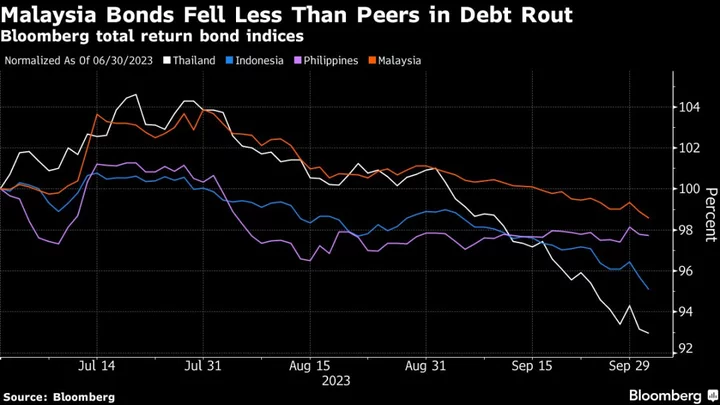

Malaysia’s bonds beat all their regional peers last quarter as rising oil prices bolstered the government’s coffers. The expected rollback of oil subsidies in next week’s budget announcement may provide another updraft.

Bonds of the oil-exporting nation returned a relatively small loss of 0.7% in the three months through September amid a torrid period for global debt markets. In comparison, their counterparts in Indonesia slid 3.6%, while in Thailand they tumbled 5.7%.

Malaysia’s government has been talking about plans to lower oil subsidies for some time to reduce its budget deficit. The 2024 budget announcement on Oct. 13 will reveal a “concrete move” away from the current blanket subsidy system, Economy Minister Rafizi Ramli said on Bloomberg Television this week. The decision may generate savings of at least $1 billion to $2 billion a year, he said.

A smaller budget deficit would open up the prospect of a reduction in debt issuance.

Net bond supply is expected to be 86 billion ringgit ($18.2 billion) in 2024, versus a forecast 91 billion ringgit this year, said Winson Phoon, head of fixed-income research at Maybank Securities Pte in Singapore. Some targeted fuel subsidies “may be confirmed in Budget 2024 to compliment fiscal consolidation,” he said.

For every $10 a barrel increase in the price of oil, the government receives an estimated 8 billion ringgit in revenue, while having to spend around 6 billion ringgit in its blanket fuel subsidies, according to a note from Maybank this week.

Faltering Demand

Any reduction in bond supply will come at a good time as demand at recent auctions has been faltering. The average bid-to-cover ratio at the most recent sales of five-year Islamic notes and 30-year conventional bonds last month was a combined 1.93 times, versus the 2023 average of 2.11.

Bond supply issues have dogged other Southeast Asian debt markets in recent months. Thai 10-year yields have jumped more than 60 basis points since the end of July, largely on concern new stimulus measures will require greater bond issuance. Indonesia’s yields jumped this week after the government announced a significantly larger debt supply this quarter than a year earlier.

There may be one potential downside from any Malaysian decision to scale back fuel subsidies: faster inflation. Still, Malaysia’s consumer prices rose just 2% in August year-on-year, down from 3.8% at the end of 2022, meaning there’s plenty of room to absorb a bit more inflationary pressure without unsettling debt markets.