Oil steadied as jitters from the short-lived armed uprising in Russia gave way to persistent concerns over the demand outlook.

West Texas Intermediate traded above $69 a barrel after a choppy session on Monday following the attempted mutiny over the weekend. Focus is returning to the factors that have whipsawed the market, including monetary policy. Traders are giving up on the idea that the the US Federal Reserve will cut interest rates, a move likely to weigh on risk assets including oil.

Aggressive rate hikes by the Fed have contributed to the headwinds for oil this year, with crude in New York set for its first back-to-back quarterly loss since 2019. China’s lackluster economic recovery has also weighed on prices.

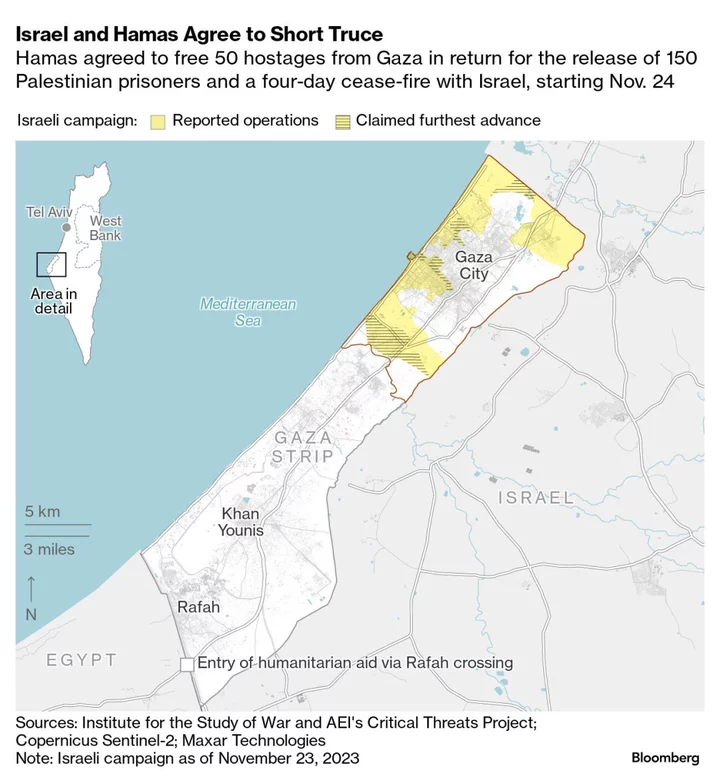

Russian President Vladimir Putin condemned leaders of the Wagner mercenary group as traitors, although his comments did little to clarify the mystery of the weekend’s events or the fate of mutiny leader Yevgeny Prigozhin. The nation is a major OPEC+ producer and any prolonged turmoil would impact oil markets.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.