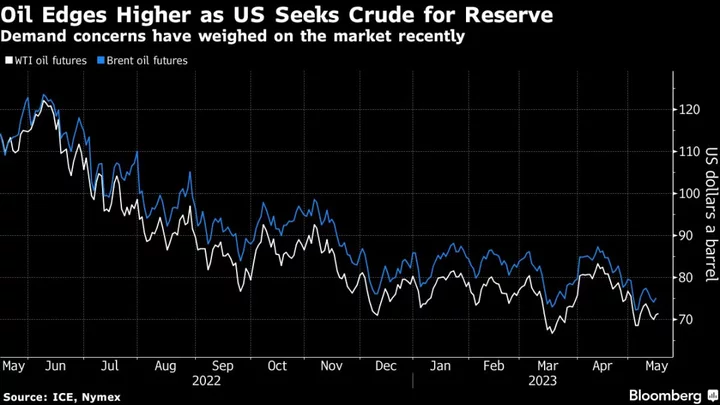

Oil headed for a weekly drop as bearishness in equity markets and dollar strength outweighed fears the Israel-Hamas war will escalate and jeopardize supply from the Middle East.

Global benchmark Brent traded above $88, paring its weekly loss to about 4%, while West Texas Intermediate was around $84. US military forces conducted self-defense strikes on two facilities in eastern Syria in response to attacks against US personnel in Iraq and Syria, Defense Secretary Lloyd Austin said.

Washington had earlier said Tehran was ultimately to blame for a spate of drone attacks on American forces while Iran said the US won’t escape unaffected if the Israel-Hamas conflict widens.

The Middle East war premium in oil futures is masking a slump in prices of some physical barrels, suggesting demand is weakening. Global stock markets have also fallen this week, while a gauge of the dollar is near the highest since November, increasing the price of commodities for most buyers.

Oil has been rocked since the Oct. 7 Hamas attack on Israel, initially surging on fears of a wider conflict but then paring those gains as the war remained contained. Still, indications that Israel will go ahead with a ground invasion of Gaza could lead to more turbulence in a region that accounts for about a third of the world’s crude supply.

“Its been a roller-coaster week for oil prices due to the ebb and flow of the war premium,” said Charu Chanana, market strategist for Saxo Capital Markets Pte. “However, demand concerns will likely build further from here as the US consumer runs out of savings and recession concerns escalate.”

Still, there continues to be signs of tightness in global crude markets, with worldwide stockpiles — including both commercial and strategic reserves — hitting multiyear lows as the Organization of Petroleum Exporting Countries and its allies curb exports, reducing the available cushion of the commodity.

Terminal users can click here for more on the Israel-Hamas War.