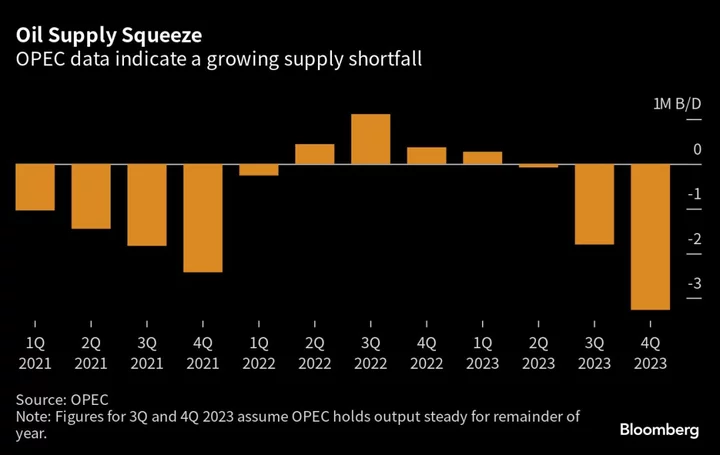

Oil steadied after rallying to a 10-month high on forecasts by OPEC and the US that output cuts will tighten the market in the months ahead.

West Texas Intermediate traded near $89 a barrel, after rising 1.8% in the prior session. The Organization of Petroleum Exporting Countries said Tuesday it expects a shortfall of 3.3 million barrels a day in the fourth quarter, while the US Energy Information Administration predicted a more modest 230,000-barrel deficit.

“These numbers will cause some to question OPEC’s claims that their main objective is to keep the market balanced as their own numbers clearly do not show this,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “Some key consuming nations will be getting a bit concerned about stronger prices.”

The bullish outlooks added more impetus to a rally that’s been underway since mid-June as Saudi Arabia and Russia curbed supply and US and Chinese demand proved relatively resilient. The International Energy Agency publishes its monthly report Wednesday, offering more clues on the state of the market.

The industry-funded American Petroleum Institute said nationwide US crude inventories rose by 1.17 million barrels last week, with gasoline and distillate stockpiles also expanding. However, holdings at the key oil storage hub in Cushing, Oklahoma, declined by 2.42 million barrels. Official data will be published later on Wednesday.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.