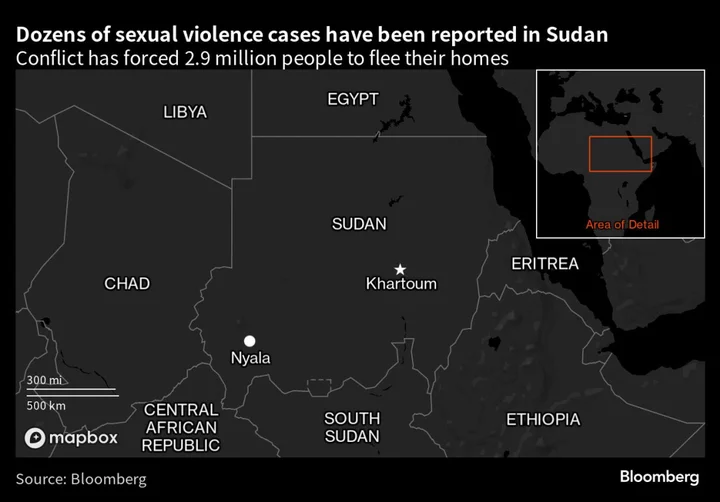

Oil held on to its biggest jump in six months as Israel said its retaliation for attacks by militant group Hamas over the weekend had “only started,” increasing the prospect of fresh instability in the region as the fighting enters its fourth day.

West Texas Intermediate was little changed after surging 4.3% on Monday, as markets reacted to fighting that began on Saturday, reigniting a conflict with broad repercussions across the region. Israel has announced its largest-ever mobilization of more than 300,000 army reservists as it attacked Gaza from the air and sea, with Prime Minister Benjamin Netanyahu vowing to “change the Middle East”, while Hamas threatened to execute hostages.

The conflict has ratcheted up oil’s volatility, following sizable swings over the past month as economic concerns weighed on a rally following supply cuts by Saudi Arabia and Russia.

While Israel’s role in global oil supply is limited, the outbreak that has already caused more than 1,500 fatalities threatens to embroil both the US and Iran. Any retaliation against Tehran, which supports Hamas, could endanger the passage of vessels through the Strait of Hormuz, a vital conduit that transports much of the world’s crude and which the Iranian government previously threatened to close. Iran denied on Monday that it was involved in the assault.

The Islamic Republic has become a major source of extra crude this year, alleviating otherwise tightening markets, but additional American sanctions on Tehran could constrain those shipments.

The conflict has turned the spotlight away from demand and supply fundamentals, with OPEC on Monday raising its forecasts for global oil demand through to the middle of the century. Thursday will see a flurry of indicators — including monthly market reports from the cartel and the International Energy Agency as well as weekly US inventory data.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.