Ocado Group Plc, an online grocer and maker of automated warehouses, is in danger of being booted out of the UK’s top equity index in what would be another blow to the country’s goal of becoming a science and technology superpower by 2030.

The market values of Ocado and commercial landlord British Land Co. have fallen so much that they’re likely to be deleted from the UK’s FTSE 100 Index in a review of the benchmark, analysts said. Preliminary results of the overhaul are due after the market closes Tuesday from the London Stock Exchange Group Plc’s FTSE Russell unit.

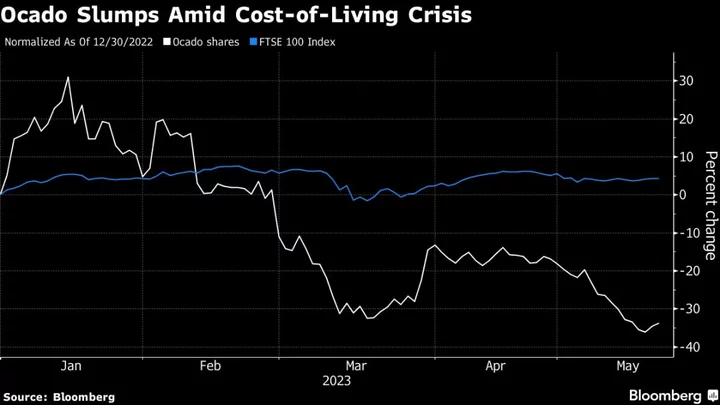

Shares in Ocado have fallen 34% this year after slumping 63% in 2022 amid a broader selloff in growth stocks. The stock soared in 2018 on a landmark deal to build robotic warehouses and license software to US supermarket chain Kroger Co., boosting the grocer’s credentials as a technology company. Ocado has partnerships with several supermarket companies, but investor focus has shifted to profitability as demand for automated warehouses slows.

Ocado declined to comment. British Land didn’t immediately reply to a request for comment.

“In terms of automatic demotion, British Land and Ocado are both hovering over the trap door, with Johnson Matthey Plc and Frasers Group Plc a little further away,” Russ Mould, investment director at AJ Bell, said in emailed comments. Liberum Capital’s Joachim Klement was in agreement, also touting Ocado as potentially facing an exit.

Final changes to the FTSE 100 will be announced May 31, using market values from the prior day’s close of trading. The shifts will take effect at the open on June 19, according to FTSE Russell, which reviews index membership every quarter.

The potential loss of Ocado from the index comes as the UK struggles to attract tech companies to its stock market. Chip designer Arm Ltd. has decided against listing its shares in London to focus solely on New York. Oxford Nanopore Technologies Plc, which was hailed as a British success story when the DNA-sequencing company went public in London in 2021, this year said it would consider listing on a foreign exchange.

“There’s a long track record of very impressive technological innovation driven out of the UK and a less impressive track record of commercializing it,” David Kneale, head of UK equities at Mirabaud Asset Management, said in an interview. “Investors need to be aware that we perhaps haven’t done as good a job as we might have done in recognizing some of that potential and maximizing some of that potential.”

Cybersecurity firm Darktrace Plc and food-delivery company Just Eat Takeaway.com were both removed from the FTSE 100 in 2021. Technology and communications companies account for about 4% index, compared to more than 18% for financials and 13% for energy, according to data compiled by Bloomberg.

Companies benefit from being in the index because so-called tracker funds have to buy their shares, while stockpickers who are benchmarked aginst the FTSE 100 also have an incentive to own them. Demotion can lead to selling as funds adjust their holdings to match the benchmark’s allocations. According to FTSE Russell’s guidelines, any stock that falls to 111th position or below is automatically deleted from the index, while any that rank 90th or above join.

The lag between the indicative index changes and the actual announcement means that the stocks set to enter and drop out may change. The final changes become effective on June 19.