Novo Nordisk A/S will invest more than 42 billion kroner ($6 billion) to expand its manufacturing facilities as it fights to maintain dominance of a weight-loss market that’s expected to hit $100 billion by 2030.

Work will begin this year on a new 170,000 square-meter factory at the company’s existing facilities in Kalundborg, Denmark, according a statement on Friday. Part of the investment is included in the 25 billion-krone capital expenditure the company already announced for this year; the rest will come over the next six years.

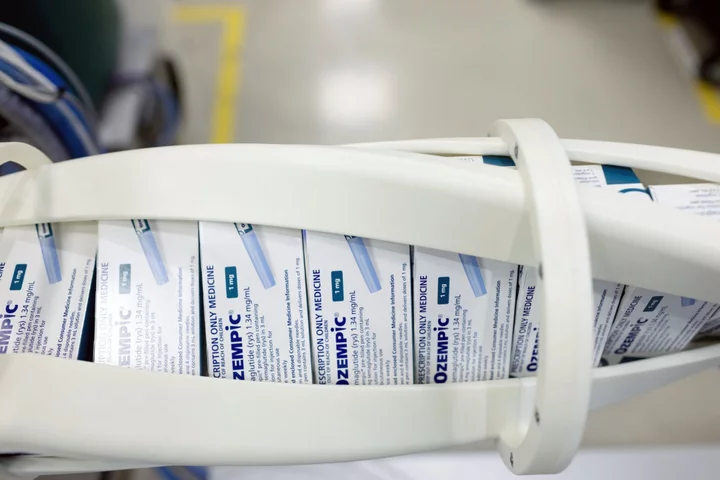

Novo said the factory will make products for its serious chronic diseases portfolio, which includes weight-loss and diabetes treatments Wegovy and Ozempic, the drugs that have vaulted Novo into the limelight and made it Europe’s most valuable company.

“Demand is so significant that most likely we cannot deliver against demand for the foreseeable future,” Chief Executive Officer Lars Fruergaard Jorgensen said in an interview. “If you look at the number of people living with obesity and the relatively few markets we have launched in, there’s a much larger demand than what we can supply.”

Read More: The Weight-Loss Drug Frenzy Is Outrunning the Company Behind It

The shares were little changed in early trading in Copenhagen, but they’ve risen 48% so far this year.

Novo is facing greater competition now since Eli Lilly & Co. received regulatory clearance to market its diabetes drug Mounjaro for weight-loss too. A commitee of the European Medicines Agency on Friday recommended extending the marketing authorization for the drug for this purpose, following the go-ahead from US and UK authorities earlier this week.

The US rival has listed its drug, which will be marketed as Zepbound in the US, at a lower rate than Novo’s shot setting up the scene for price war between the two companies.

The Zepbound approval means the market growth is going to accelerate now as there will be two highly efficacious obesity medicines on the market, Fruergaard Jorgensen said, adding: “Then it’s a play on innovation, and that’s the type of competition we have had with Eli Lilly for 100 years.”

Read More: Ozempic’s Rival Sets Up Price War in Weight-Loss Drug Market

Novo has been dogged by manufacturing problems since facing unprecedented demand for its weight-loss drug, which can help users shed on average about 15% of their body weight. As well as expanding its own manufacturing it’s also been working with third party contractors to try to ease constraints.

Demand in the US, the world’s largest drug market, has been particularly intense and Novo recently said at least 50 million Americans could need access to obesity drugs right now. Novo is currently only treating about 500,000 US patients and has restricted the sale of some starter doses there to safeguard supplies for people already on the medicine.

The intense popularity of these weight-loss drugs, which has turned Lilly into the most valuable health-care company in the world, is likely to lead to ongoing supply shortages for some time. Lilly said it’s also investing heavily to make more of their weight-loss and diabetes drugs.

Despite the “billions of dollars invested in ramping up supply, we do recognize that the demand for these products is significant,” Anat Ashkenazi, Lilly’s chief financial officer, said in an interview earlier this week. “We’ll likely be in a tight situation for quite some time.”

The obesity drug wars are likely to heat up further this weekend, when Novo is expected to present data at the American Heart Association meeting from a big trial showing that Wegovy can prevent heart attacks and strokes in patients who don’t have diabetes. The findings could pressure insurers to cover the drug if it has more perceived health benefits.

Fruergaard Jorgensen said he expected the outcome of its SELECT trial to fuel even more demand for Wegovy.

--With assistance from Alastair Reed, Madison Muller and Robert Langreth.

(Updates with EU authorization of Lilly drug in sixth paragraph)