Nike Inc. shares rose in late trading after the sportswear giant reported a drop in its stockpile of inventory — a sign it’s making progress in moving out older merchandise for newer, more-profitable items.

Inventory fell 10% from a year earlier to $8.7 billion, which was a bigger decline than analysts expected, according to estimates compiled by Bloomberg. Revenue of $12.9 billion for the quarter ended Aug. 31 was just short of Wall Street’s average estimate, while gross margin, a key gauge of profitability, was higher than expected.

“We’re very comfortable with the level of inventory in the marketplace, in relation to the retail sales that we’re seeing,” Chief Financial Officer Matt Friend said on a conference call with analysts on Thursday.

Nike has been offering discounts to get excess merchandise off of store shelves — a strategy that erodes profitability. So the decline in inventories is a sign that the company’s tighter management is paying off. Earnings per share of 94 cents outpaced expectations.

Management expects revenue growth in the company’s fiscal second quarter to be up slightly versus the same period last year, while gross margin is seen expanding about 100 basis points.

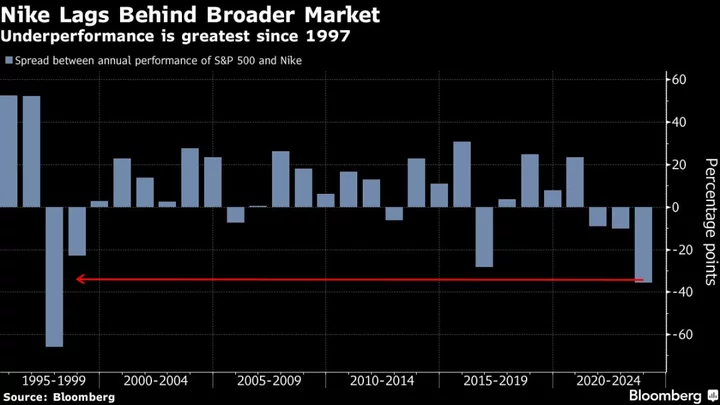

The shares rose as much as 9.6% in after-market trading in New York, with gains accelerating during the company’s conference call with analysts. The stock has dropped 23% year-to-date through Thursday’s close.

The company also reiterated its guidance for the full fiscal year. Revenue is seen rising in the mid-single digits, with margins up as much as 160 basis points. Friend said Nike is closely monitoring demand ahead of the holiday season.

In Nike’s home market of North America, revenue fell 2% and was just below expectations. Sales in the Greater China region cooled as well, with growth of 4.8% falling short of estimates. Executives said Nike is still gaining market share in China.

The company reported high-single digit to low-double digital growth with its retail partners, including Dick’s Sporting Goods Inc. in North America. It’s currently undergoing a “reset” with longtime partner Foot Locker Inc., with sales expected to decline in the near-term, Friend said.

(Updates share trading and adds comments from conference call)