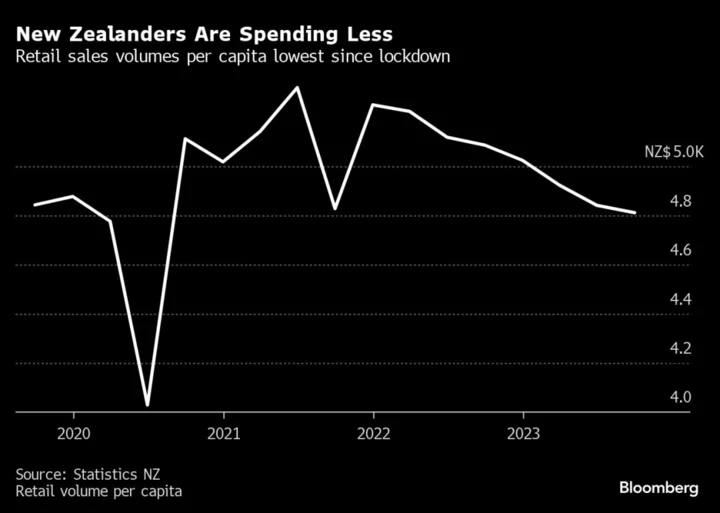

New Zealand consumers are spending less per person after adjusting for inflation as high interest rates and rising prices reduce purchases of luxury items and other discretionary goods.

Retail sales volumes slowed to NZ$4,811 ($2,900) per person in the third quarter, Statistics New Zealand said Friday in Wellington, That’s the lowest level since mid-2020 when the economy was locked down during the Covid-19 pandemic.

High home-loan interest rates and surging inflation have slowed consumer spending and put pressure on retailers. Discount department store chain the Warehouse Group recently reported a 6.7% fall in first-quarter revenue even though inflation was 5.6% in the year through September.

Overall retail sales volumes were unchanged in the quarter, today’s report showed. That’s the first quarter since 2021 not to show a contraction in spending.

Spending has been underpinned by a 2.7% jump in New Zealand’s population to 5,269,000 — the fastest pace since comparable data began being collected in 1992.

“Sales volumes were flat on a seasonally adjusted basis, maintaining the weakening trend particularly in per capita terms that’s been in play since the 2021 bounce marking the end of the Auckland lockdown,” said Miles Workman, senior economist at ANZ Bank New Zealand in Wellington.

Still, “while households have reduced their discretionary spending, there is some tentative evidence of a bottoming out,” he said, citing quarterly gains in hardware and in accommodation, which reflects continued growth in tourist arrivals.