An effective and massively popular weight-loss drug has made Novo Nordisk A/S billions of dollars and turned it into the most valuable company in Europe. With the US Food and Drug Administration approval of another option from Eli Lilly & Co. on Wednesday, the Danish drugmaker now has some serious competition.

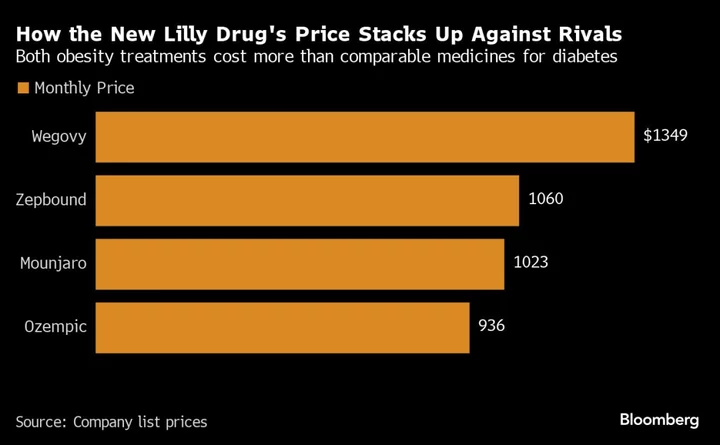

Novo has reaped mega-profits from its obesity drug Wegovy by selling it for a premium price of $1,349 a month in the US — significantly higher than its diabetes drug, Ozempic, even though the two contain the exact same active ingredient.

On Wednesday, Lilly undercut that price with its newly approved weight-loss drug Zepbound. The drugmaker said it plans to charge more than 21% less — or about $1,060 a month — for its shot, which will hit US pharmacies after Thanksgiving. Lilly also already sells the same drug for diabetes under the brand name Mounjaro. That retails for around $37 less a month.

Insurance companies have so far been reluctant to cover Wegovy for obesity, partly because of its high cost. While that hasn’t stopped demand from surging, it has meant the drug isn’t reaching many potential patients.

A lower list price could appeal to people who have little or no insurance coverage for weight-loss drugs. But it’s also an opening move by Lilly in a coming war between the two drugmakers to win over insurers’ dollars.

Even as list prices remain high, drugmakers often offer insurance companies steep behind-the-scenes discounts in exchange for favorable coverage, especially when there’s competition from a very similar drug. What drugmakers lose in rebates — as these deals are often called — they gain in potential market share. Winning over the fragmented, complex and lucrative US health-care system is imperative for Lilly and Novo in maximizing long-term profits.

Both drugmakers are experts at navigating the behind-the-scenes fights with insurers for access to their patients. For years, the two competed to get coverage for injectable diabetes drugs, including more recently Mounjaro and Ozempic. They have historically split market-share for diabetes treatments, but the stakes are higher for weight-loss medicines: Analysts suggest it could become a $100 billion market.

“Both drugmakers will want to get broad access, so insurers will likely pit one against the other to secure the biggest discount,” said Michael Shah, an analyst at Bloomberg Intelligence.

So far this year, he estimates that Novo has discounted Wegovy by around 55% to gain access to plans. With the newfound competition, “we will likely see rebates go up,” he said, referring to the back-end discounts that drugmakers provide to insurers. This will all ultimately be good for patients. While they rarely pay the full list price, even now, widespread insurance coverage would open up much more access.

Lilly is already giving hints of the marketing battle to come.

In a statement announcing Zepbound’s approval, Lilly called the drug “a powerful new option” for treating weight loss and emphasized its lower price. In trials, the obesity drug has helped patients taking it lose up to 18% of their weight compared to people taking a placebo. It is viewed by some obesity doctors as slightly more potent than Wegovy. The medicines have never been formally compared in a big weight-loss trial, though Lilly has one underway.

During a presentation at a UBS investor conference hours after the approval, a top Lilly executive also said that the company priced Zepbound lower than Wegovy to appeal to employers, who offer millions of Americans health-insurance coverage. They’ll have to opt-in to add obesity medicines to rosters of drugs they cover — and the cheaper they are, the more likely employers are to do that.

A lower price will “signal from our side” that Lilly is taking payer concerns about drug costs seriously, said Patrik Jonsson, a Lilly executive vice president, at the conference.

Most Wegovy users in the US who have insurance coverage for the drug already, pay $25 a month or less for it, a Novo spokesperson said in an emailed statement.

Richard Evans, an analyst at SSR Health and drug pricing expert, said, paradoxically, Novo’s pricier Wegovy could give it an advantage when negotiating behind the scenes with insurers. “Its higher list leaves more room for a larger rebate,” he said in an email.

Drug benefit managers sometimes prefer drugs with higher list prices combined with bigger rebates because they can collect higher fees.

The obesity drugs wars are likely to heat up further this weekend, when Novo is expected to present data at the American Heart Association meeting from a big trial showing that Wegovy can prevent heart attacks and strokes in cardiovascular patients without diabetes. Those findings could also pressure insurers to cover the drug if it has more perceived health benefits.

Lilly hasn’t yet completed a similar trial for Zepbound, though it is in the works.

Demand for this new class of weight-loss and diabetes drugs, called GLP-1 agonists, has been far higher than anyone predicted a few years ago. Wegovy, Mounjaro and Ozempic have all gone in and out of shortages in the last year. Novo is still struggling with supply of Wegovy and Ozempic, while all doses of Mounjaro are listed as available on an FDA shortage database.

“We suspect that demand is going to immediately increase,” with the new approval, said Angela Fitch, president of the Obesity Medicine Association and chief medical officer of Knownwell, a startup which offers obesity care. “This demand is going to put pressure on all of us” to find a way to get patients the drugs they need.

--With assistance from Madison Muller.