The venture capital firm that bankrolled the “Tesla of tractors” is bucking the trend of retreating climate tech investors.

Brussels-based Astanor Ventures announced Tuesday that it raised €360 million ($385 million) for a new fund. The firm already has investments in more than 40 startups dedicated to improving efficiency in the food and agricultural sectors. With the new fund, it will continue to invest in solutions for the food system, which is responsible for up to a third of global greenhouse gas emissions.

“Every single person on earth needs to eat,” says Eric Archambeau, co-founder and managing partner at Astanor Ventures. That creates a “fundamental attractivity” for investors, he adds.

To provide comprehensive solutions, he says Astanor is also widening its investing net to include technologies that address biodiversity and water, two areas closely linked to food and agricultural production.

Astanor has invested in startups that include US-based Monarch Tractor, which makes autonomous electric tractors, as well as UK-based seaweed-packaging upstart Notpla and German alternative protein producer MicroHarvest. Archambeau says he has advised portfolio companies to prepare for a scenario where they’ll need to operate without fresh funding for two years, instead of setting aside the six-month cash reserve that Silicon Valley startups typically allocate.

Despite raising the new fund, Archambeau says his team has also become “very cautious” about picking startups. They made only one investment over the last six months.

“Investors are much less inclined to invest in our sector today than they were two years ago,” Archambeau says. Earlier this year, one of his portfolio companies fundraised at a valuation of 70% lower than what the startup secured in 2021, Archambeau says. Another portfolio company halved its valuation while three have lost unicorn status — that is, startups valued at $1 billion or more.

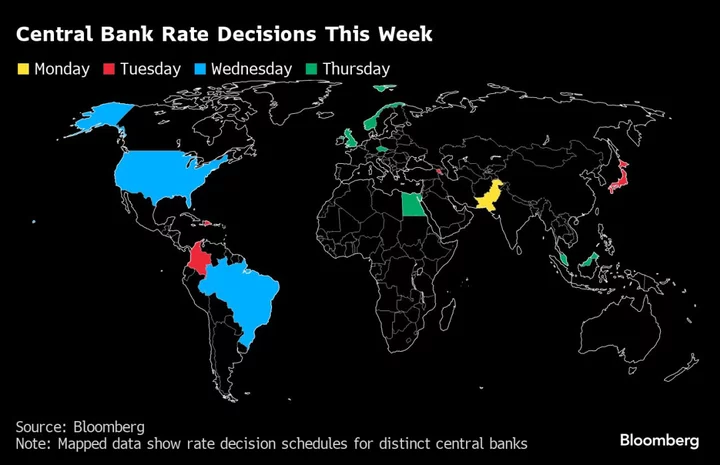

The new fund’s announcement comes as venture money for climate tech has slipped substantially. Funding for climate-tech startups in the first half of 2023 plunged by as much as 40% compared to a year ago, according to Climate Tech VC, a market research group.

It is too soon to tell how the dip is impacting the performance of climate tech investors — who typically seek payback over 10-plus years — but the immediate damage is clear: As funding contracts, startups’s early backers are gut-checking the lofty valuations.

A dip in valuations could end up being a healthy “correction” to the overheated sector, Archambeau says. With fewer investors chipping in, he also sees a greater chance to hunt for bargains.

That logic appears to be resonating with funders. Galvanize Climate Solutions announced a new fund last week with more than $1 billion and other firms are forming to invest in areas such as biodiversity. Astanor’s new fund exceeded its fundraising target as well.

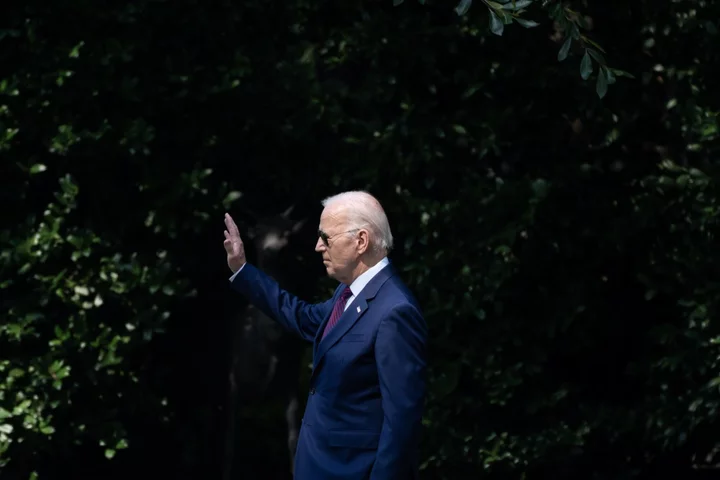

Archambeau says the recent environment reminds him of the previous climate tech boom and bust. From 2006 to 2011, global venture firms plowed more than $25 billion into climate tech and lost more than half of their investment. Some technologies could not be commercialized in the timescale needed for profitability while others failed to take hold due to unrealistic business assumptions. A prolonged capital winter for climate tech followed, until low interest rates, big company pledges to zero out carbon emissions and new policies such as President Joe Biden’s Inflation Reduction Act revived investors' interest.

That sentiment is once again changing. Though Astanor’s new fund and others will provide much-needed capital for the climate tech market, Archambeau warns startups will have to make their case to more discerning investors through 2023 and possibly beyond.

“Two years ago, people would queue up to invest without asking too many questions just because of the potential,” he says. “Today, they're waiting to see more proof.”