No matter how alert Italian Prime Minister Giorgia Meloni is to the dangers, she just can’t seem to avoid provoking financial markets.

Two months after her government was rocked by news of a shrinking economy, a botched attempt to tax banks and last week’s worsening budget outlook have added to the risks haunting bond investors.

They’ve reacted by offloading Italian government debt, driving the yield on 10-year securities to the highest in a decade. Banks in the euro-zone’s third-biggest economy are adding to that pressure, selling their own holdings of government bonds at the fastest pace in two decades.

That hurts Meloni’s ability to refinance Italy’s €2.8 trillion ($2.9 trillion) debt load and officials are starting to fret.

Italy on Wednesday is coming to terms with a horrific bus crash that killed at least 21 people near Venice. As the shock subsides, attention will return to the economic challenges facing Meloni and whether she can steer her fractious coalition through the financial headwinds without triggering a crisis.

“I share the concerns and worries of families and businesspeople that live with debt on their shoulders,” Finance Minister Giancarlo Giorgetti said last month. “I have a big debt load on my shoulders.”

To be sure, few investors expect a full-blown market meltdown.

The European Central Bank’s pledge last summer to keep borrowing costs in the bloc’s disparate economies from diverging wildly was a gamechanger for anyone looking to bet big against Italy. Last week, the spread between Italy’s 10-year yields and equivalent German paper did briefly surpass 200 basis points, a closely watched level, but it’s still a far cry from the 570-basis point gap that ultimately forced Berlusconi out.

Italy’s budget does imply less fiscal consolidation than initially expected, but Societe Generale strategists including Adam Kurpiel also reckon the revision “doesn’t change the big picture.” They’re keeping an estimate of €310 billion-€330 billion of gross bond supply for 2024 unchanged.

Read More on Italy:

Autostrade Bid Pits Italian PM Meloni Against Deputy Salvini Italy On Track for Highest Total of Migrant Arrivals Since 2016Italy’s Factories Seen ‘Trapped’ in Recession With No Way OutMeloni, Macron Challenge EU as Budgets Defying Deficit Limit

And yet the officials around Meloni are clear that keeping investors on side in 2024 will be a major test for her over the coming months.

Her alliance’s spending pledges have stalled efforts to trim a debt load exceeding 140% of output and European elections next year are already setting coalition partners against each other as evidenced by Deputy Prime Minister Matteo Salvini’s show of defiance over Autostrade this week. Chairing the Group of Seven will bring its own pressures too, placing the prime minister in the global spotlight in a way she has never experienced before.

“With growth slowing, future fiscal consolidation is very important,” said Evelyne Gomez-Liechti, a strategist at Mizuho International Plc. “Meloni needs to deliver some of that, or plans to do so in the coming years, to avoid debt sustainability worries resurfacing again.”

Financial turmoil was a formative part of Meloni’s political education — she had a front row seat when the bond market toppled Silvio Berlusconi in 2011. Then the Brothers of Italy leader took office last year days before UK Prime Minister Liz Truss quit amid another disastrous selloff. That mess left Meloni persuaded that bad decisions unsettle investors more than the talk of plots against Italy that some of her party’s conspiracy theorists indulge in, according to people familiar with the matter.

The Italian premier began by imposing fiscal discipline on her three-way coalition, but rising interest rates combined with data in July showing the economy performing far worse than officials had hoped have since threatened its populist spending ambitions.

Meloni’s government tried to pull in extra cash with a windfall on banks’ profits in August. Instead, that wiped $10 billion from the market value of Italian lenders and left many investors questioning her commitment not to rock the boat. The coalition has now largely backtracked.

The scale of the challenge became clearer last week when officials admitted Italy won’t return to European Union deficit limits until 2026. They no longer foresee a so-called primary surplus next year, where revenues exceed spending before interest costs — previously seen as a key commitment to fiscal discipline.

Italian lenders, which currently hold the highest stock of national debt across the euro-zone, have begun to cut that back, according to Bloomberg analysis of newly released data.

It’s not clear if that’s a response to the profit-tax measure, but the shift has captured the attention of officials all the same.

A more benign explanation was offered by strategists at Unicredit SpA, Italy’s second biggest bank. They argued that the drop may reflect an push to diversify holdings now that yields on other government bonds are so much higher, according to UniCredit strategists. Germany’s 10-year yield is trading just below 3%, compared with less than zero just two years ago.

Combined with ECB efforts to unwind past bond-buying, that shift puts a greater onus on other investors to plug the gap. That’s happening for now as Italian households and non-financial corporations take advantage of the highest yield in the euro area.

Whatever the case, officials privately acknowledge that recent events have damaged confidence and people close to Meloni worry that she is increasingly boxed in: She has to keep both her coalition partners and her voters happy, while also abiding by EU requirements for sound public finances.

Meloni’s hope, as expressed by Giorgetti at a press conference last week, is that markets and partners “will understand the situation.” But she doesn’t have much of a margin for error.

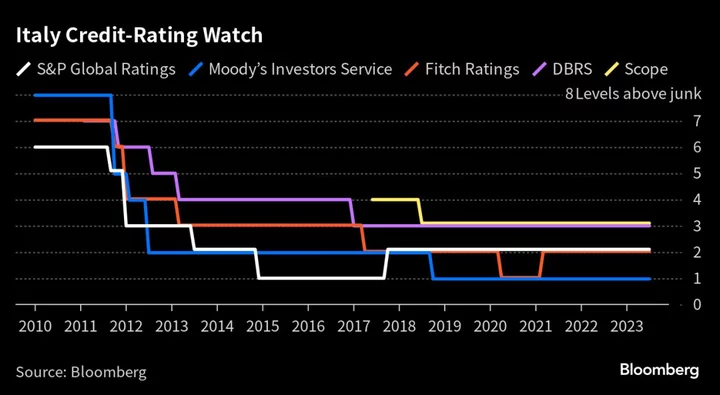

The country is graded only one notch above junk with a negative outlook by Moody’s Investors Service, which is expected to publish its next assessment in November. Italy might also be vulnerable if inflation gets stuck above the ECB’s 2% target, forcing rates to remain elevated.

Rabobank analysts including Erik-Jan van Harn have mapped out a scenario where 3% inflation pushes the country’s interest-to-revenue ratio above 10%, a level they say “warrants at best a speculative” credit rating.

Guillermo Felices, global investment strategist at PGIM Fixed Income, sees debt sustainability as one of the “most under-appreciated risks” in the euro zone, with the periphery most vulnerable of all.

“What’s clearly helped these periphery spreads is the upside growth,” he said. “But as growth concerns in the euro zone have increased and interest rates rise, then that equation starts to become a little bit more unstable.”

--With assistance from Aline Oyamada, Chiara Albanese, Constantine Courcoulas and Zoe Schneeweiss.

(Updates with reference to bus crash in)

Author: Alessandra Migliaccio, Alice Gledhill and Giovanni Salzano