Online dating stocks have mostly been ghosted by this year’s scorching technology rally. Many on Wall Street continue to keep the faith.

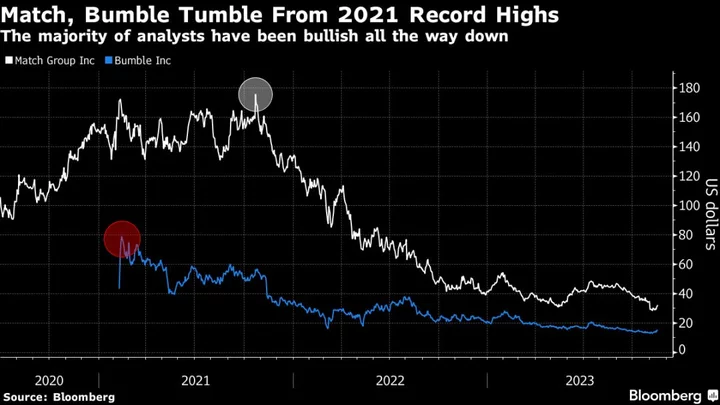

Match Group Inc., which owns popular apps including Tinder and Hinge, and Bumble Inc. have seen double-digit declines in 2023 and have shed more than 80% of their value from 2021 peaks. Slowing growth, intensifying competition, and struggles in retaining paid users are among the challenges the industry faces.

Still, the majority of analysts hold bullish views and JPMorgan Chase & Co.’s Cory Carpenter is among those who are undeterred. Carpenter believes that Match’s growth is poised to re-accelerate as marketing and new features help bring new customers to online dating, used by roughly half of single people in North America.

“We think that 50% goes higher, but to get it to go higher you need new product, you’ve got to give people a reason to join,” said Carpenter, who has overweight ratings on both Match and Bumble. “We’re confident that they’re on the right path.”

For most of Match and Bumble’s slide from their respective peaks, neither have had a sell rating, according to data compiled by Bloomberg. Both stocks have recently hit record low valuations, and trade at about 2.4 times estimated sales. In comparison, the Nasdaq 100 trades at about 4 times, according to data compiled by Bloomberg.

That valuation is “extremely attractive” for Match in particular, according to Evercore ISI analyst Shweta Khajuria, adding that the free cash flow profile and margins generated are not “comparable to a lot of other assets.” She puts the pullback in the stock down to a downward inflection in Tinder’s growth rate.

For Bumble — which recently appointed Slack Technologies Inc. CEO Lidiane Jones to replace founder Whitney Wolfe Herd — fundamentals are “fairly healthy,” said Khajuria, noting that the top-line growth rate is in the high-teens, at least for 2023, and that margins have potential to grow from the current mid-20% range.

Bumble Founder Whitney Wolfe Herd to Step Down as CEO

Third-quarter earnings were a mixed bag for both Match and Bumble, though the biggest takeaway was with their outlooks. Match slumped to a record low as fourth-quarter guidance missed analyst expectations. Bumble’s 2024 outlook could be seen as conservative, according to Morgan Stanley’s Lauren Schenk and Brian Nowak.

One outlier has been Grindr Inc., the owner of the eponymous dating app, which raised its revenue forecast for 2023 this week, sending the stock to the highest since March.

Still, the market is challenging. Mayuranki De, research analyst at fund manager Global X ETFs, said the landscape has “undergone significant evolution.” De highlighted the increasing prevalence of exclusivity strategies being employed by dating apps, such as Tinder Select, a membership priced at $499 per month offered to less than 1% of users.

“The central challenge lies in convincing users to opt for these exclusive features,” said De. Outside of exclusivity, De adds that oversaturation in the dating app industry has contributed to users feeling overwhelmed, making it difficult for them to discern meaningful differences between platforms, leading to burnout.

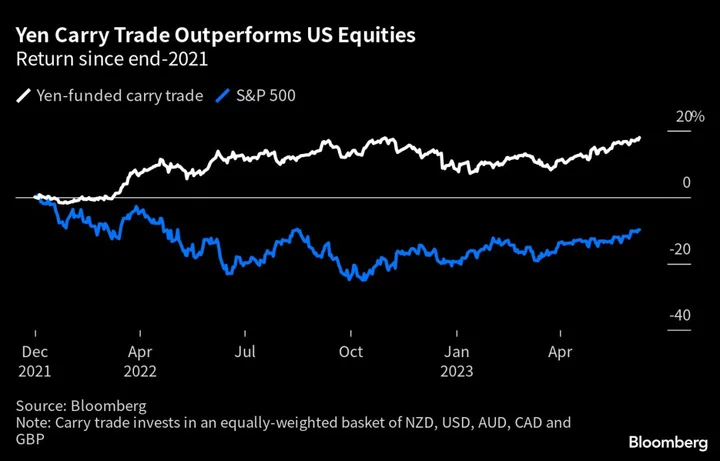

Tech Chart of the Day

The Nasdaq 100 Index has rallied 9.7% in November, adding $1.7 trillion in value, driven higher on signs of cooling inflation and bets that Federal Reserve interest rates had peaked. The index on Wednesday closed near its 2023 high set in mid-July.

Top Tech Stories

- Cisco Systems Inc., the largest maker of computer networking equipment, plunged in late trading after giving a disappointing forecast, adding to concern that corporations are reining in their technology spending.

- Sapeon Inc., a semiconductor startup backed by South Korean conglomerate SK Group, unveiled its latest artificial intelligence chip to ramp up its offerings in the increasingly competitive market.

- ValueAct Capital Management sparked a rally in Walt Disney Co. shares after becoming the second activist investor to amass a stake in the media and entertainment giant.

- Sonos Inc. is cutting jobs in its product development organization as the company prepares to expand into headphones, adding to recent upheaval at the maker of smart speakers and audio gear.

- US lawmakers are pressing Apple Inc. for information about its streaming show The Problem With Jon Stewart, which was reportedly canceled following disagreements over how to handle topics such as China.

- Lenovo Group Ltd. is targeting revenue growth in personal computers this quarter after signs of a long-awaited recovery helped it report a smaller-than-feared profit decline.

Earnings Due Thursday

- Premarket

- Alibaba

- Stratasys

- Netease

- Warner Music

- Postmarket

- Applied Materials

- Dolby Labs

- Globant

--With assistance from Subrat Patnaik and Natalie Lung.

(Updates stock moves at market open)