Lego A/S is putting its money on China’s expanding middle class, the world’s biggest, shrugging off short-term economic woes in the Asian nation.

The world’s largest toymaker will invest in China, adding new stores and production capabilities, because it sees the growing demographic helping the Asian country become a long-term growth market, according to Chief Executive Officer Niels B. Christiansen.

“It may seem strange to invest in China when the market contracts, but we still see very, very big potential,” the CEO said in a phone interview in connection with the Danish firm’s earnings report. As a family-owned company, it can focus on long-term prospects, he said.

Even in the short term Lego can find Chinese growth as there are dozens of medium-sized cities where it hasn’t yet rolled out its well-known colorful building blocks, according to Christiansen.

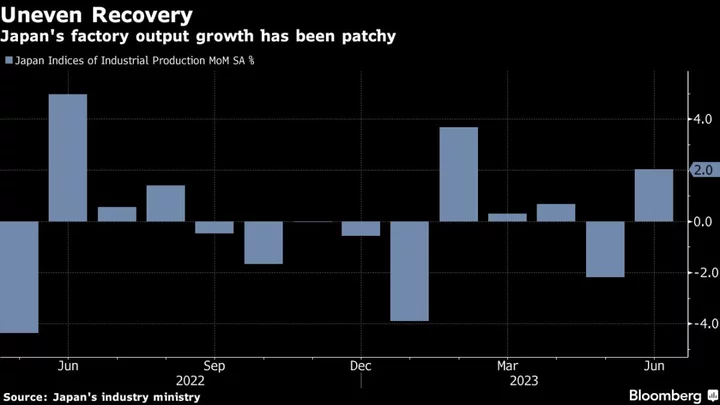

China’s economy is slowing down as investments in residential properties decline, the export outlook worsens and deflation shows signs of setting in. Economists see gross domestic product expanding 5.1% in 2023 from the prior year, less than previously, according to the latest Bloomberg survey.

“It’s clear that the uncertainty around the Chinese property market is affecting consumers as they don’t go to the stores and spend as much money as they normally would have,” the CEO said. “We don’t know how long that will last but we will sit it out.”

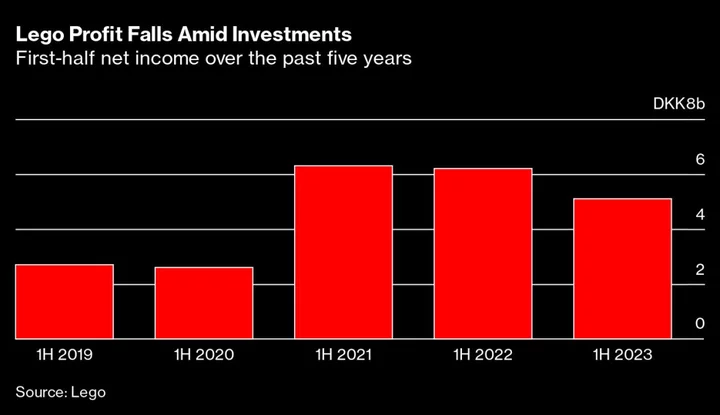

The company on Wednesday reported a 1.5% increase in global revenue for the first six months of the year, to 27.4 billion kroner ($4 billion). Meanwhile, net income declined by 18% in the period to 5.1 billion kroner as expenses, which include investments, rose 10%.

Lego expects to surpass 500 stores in China this year and will probably open “close to” 100 new shops a year over the next coming years, the CEO said. It’s winning share in a “declining” market, he said, without providing exact numbers.

There’s room to grow, given the Asia & Pacific region is Lego’s smallest in terms of goods sold.

“The people who’re most interested in our products and who buy the most are the middle class,” Christiansen said. “And in China, we may see the middle class almost doubling over the next five to 10 years.”

The company is controlled by the third and fourth generations of the billionaire Kirk Kristiansen family. Kjeld Kirk Kristiansen has a net worth of about $7.2 billion, according to the Bloomberg Billionaires Index, while his three children — Agnete, Sofie and Thomas — each have $6.8 billion.