South Korea’s inflation outstripped forecasts in September, reinforcing the case for the central bank to keep its policy settings tight for longer.

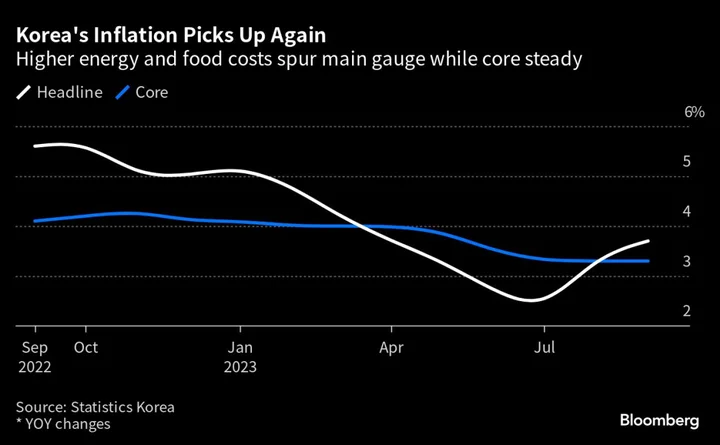

Consumer prices advanced 3.7% from a year earlier, quickening from 3.4% in August, the statistics office reported Thursday. Economists surveyed by Bloomberg had expected the rate to speed up to 3.5%.

The Bank of Korea is keeping a close eye on inflation as it maintains its benchmark interest rate at a restrictive level of 3.5% to tamp down price pressures.

The central bank expects higher energy and food costs to put upward pressure on prices toward the end of the year. Inflation briefly cooled to levels below 3% at the start of the summer before a resurgence in August.

The BOK meets later this month to determine whether it will continue to hold rates, as it has done since January, or resume hiking. All board members have said they’re open to raising the rate by another quarter percentage point if needed, a stance that is largely in line with the views of global central bankers looking to stay alert against a renewed flare-up in prices.

The bank has held policy steady since its first meeting this year, after earlier leading the pack of monetary authorities tightening policy in the early stages of the recovery from the pandemic. It started its rate-hike cycle in August 2021.

Since January the BOK has been reluctant to raise rates given the fragility of an economy hit by weaker external demand. The risk that a deeper property-market correction could also weigh on economic growth is another factor making it harder for the bank to tighten policy further.

At the same time, a pick-up in household borrowing in recent months is making policymakers cautious about any policy loosening.

What Bloomberg Economics Says...

“We don’t see the BOK tightening further given its worries about the potential for financial instability stemming from non-bank lenders with high exposure to a shaky property market.”

-Hyosung Kwon, economist

To read the full report, click here

(Adds details and a chart)