Two JPMorgan Chase & Co. veterans have joined Brahman Capital Management Pte to run a macro fund targeting Japan’s interest rate market, just as investors brace for a historic rise in borrowing costs.

Ville Vaataja, the ex-head of Asia Pacific G-10 rates trading at the bank, has teamed up with former Japan fixed-income trading chief Shigetoshi Kobayashi to oversee the Brahman Kova Japan Fund. It currently manages around $100 million, started trading last month and aims to have about 75% or more of its exposure to the Japan rates market.

“The outlook for volatility and price action in the Japan market is more exciting than we have seen at any point in the past 25 years,” said Vaataja, whose career at JPMorgan spanned that period. “We strongly believe that for years and decades ahead, we will have structurally higher realized volatility.”

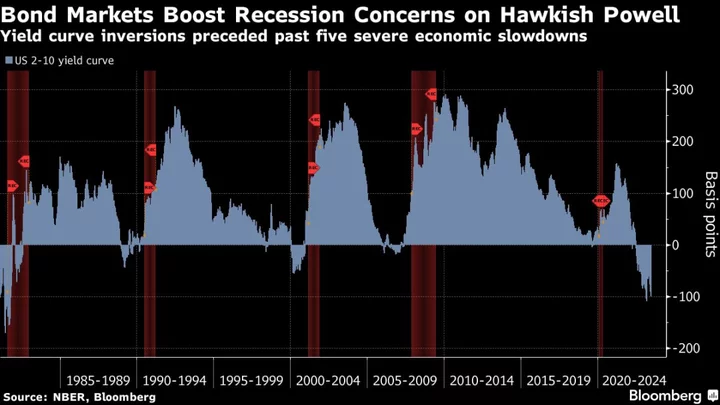

Vaataja and Kobayashi are taking hold of the reins as the ¥1,079 trillion yen ($7.2 trillion) Japanese government bond market is experiencing its biggest swings since the global financial crisis, buffeted by bets that the last anchor to the world of rock-bottom interest rates is lifting off. Yields on 10-year JGBs have risen to a decade high as Japan exits a deflationary environment, fueling expectations the central bank is getting closer to ending its negative rate policy.

Real Inflation

Vaataja reckons inflation will continue to overshoot the BOJ’s predictions, meaning policymakers have to “act sooner rather than later” in raising rates, barring a severe global recession.

Consumer price gains in the world’s third-biggest economy hit 4% for the first time in more than four decades in December, though the pace of increases has slowed.

“We strongly believe inflation in Japan is real and it’s here to stay,” Vaataja said in an interview from the fund’s Robinson Road office in Singapore on Thursday. “And with that, BOJ is behind the curve.”

The fund had some steepening bias in its portfolio, he added.

The launch of the fund comes at a challenging time for trading Japanese rates. Bets against the nation’s debt for instance have worked well in the past four years, with the securities posting losses for 11 out of the past 16 quarters. But with central banks in other major economies expected to start cutting rates next year, the risks for global bond markets including Japan could come from many directions.

The Brahman Kova Japan Fund will invest in everything from bonds to swaps to currency forwards and other derivatives to express their market views, he said.

“In all likelihood, we’ll have a structurally steeper curve which will make for both the relative value trades and directional trades for an active fund like ours,” he added.

Vaataja also previously worked in Japan as co-head of fixed-income trading at JPMorgan with Kobayashi, whose career included a stint as head of JGB trading at the US bank. Kobayashi exited JPMorgan in November 2021 after more than a decade at the firm.

--With assistance from Masaki Kondo.