Chancellor of the Exchequer Jeremy Hunt and the UK’s largest lenders have agreed people should be given a 12-month grace period if they miss mortgage payments in a bid to ease the burden on millions of homeowners of rapidly rising mortgage rates.

For those people at risk of losing their home, lenders have “agreed there will be a minimum 12 month period before there’s a repossession without consent,” Hunt said in an interview with Sky News. That should help mitigate concerns of immediate foreclosures even as mortgage costs surge.

The breakfast meeting in Downing Street between Hunt and banks including HSBC Holdings Plc, Barclays Plc, NatWest Group Plc and Lloyds Banking Group Plc, came a day after the Bank of England raised its benchmark interest rate by a half percentage point to 5%.

The meeting also covered other forbearance arrangements, many of which were already in place. They include “contract variations” that allow banks to extend mortgage terms beyond retirement age and switch from repayment to permanent interest-only deals. Banks have also already committed to provide tailored support to mortgage holders who are in distress, in arrears, have missing payments or are in fear of repossession.

Hunt highlighted that people who make such changes can return to their original package with no penalty or impact on their credit scores within six months.

Hunt and Prime Minister Rishi Sunak are scrambling to show they’re live to the pressures on household budgets. With inflation proving particularly sticky at more than four times the official target, the economic pain threatens to sink the chances of the Conservative government overturning a double-digit poll deficit on Labour to win a general election that’s expected next year.

Both Hunt and Sunak ruled out direct government assistance themselves and there was no mention of help for renters, who could see the higher costs passed onto them by landlords. Banks, meanwhile, have consistently said the existing measures are appropriate and so far they see little signs of distress among customers. Almost all people who were given mortgages in the past 5 years faced affordability stress tests for rates of up to 7%.

“We are likely to see mortgages become slightly more expensive, but we do not anticipate a wholesale withdrawal from the market,” said Ben Merritt, director of mortgages at Yorkshire Building Society.

“It’s important to note that responsible lenders stress affordability on all applications, so whilst household budgets are being squeezed, the ability for borrowers to repay their mortgage in a rising rate environment is considered when approving their mortgage.”

What Bloomberg Intelligence Says

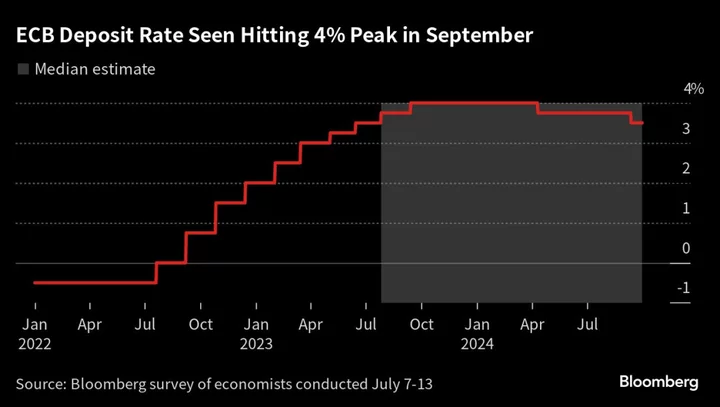

With markets expecting rates to now reach as much as 6% vs. 4.75% expected earlier, any material reversal in swap rates looks a distant hope now.

This jump will disproportionately affect younger generations, exacerbating the painful wealth and ownership divide. Banks might steer clients toward longer-duration offers to add to visibility and lower churn.

— Tomasz Noetzel, BI Senior Industry Analyst

--With assistance from Leonard Kehnscherper, William Shaw, Katherine Griffiths and Kitty Donaldson.