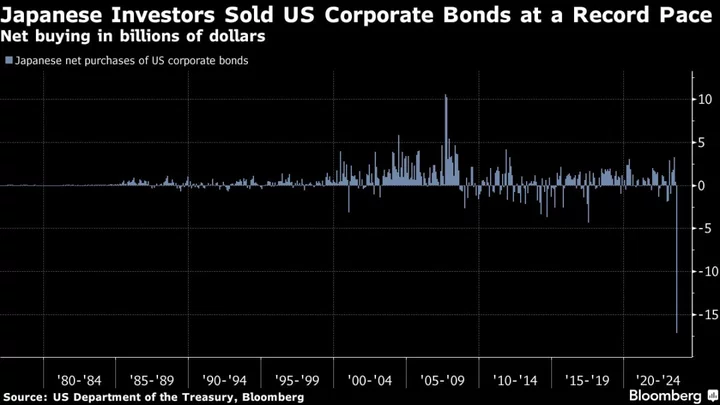

Credit managers are nervously awaiting data this coming week that will show whether a Japanese pullback from US corporate bonds in August was a blip or the beginning of a trend.

Government bond yields in Japan have risen in recent months as speculation grows that the nation’s central bank will step back from its super easy monetary policy. That may spur investors there to move money home to take advantage of higher returns.

Such moves by Japanese investors, traditionally among the biggest buyers of US corporates, could reduce global market liquidity and increase the risk of volatility. Demand for US company debt from Asian investors, including in Japan, has already noticeably softened in recent months, according to two bankers who weren’t authorized to speak publicly and asked not to be identified.

Japanese investors sold a record net $17.2 billion of US corporate debt in August, the latest Treasury Department data show, as the highest hedging costs in more than 20 years make the securities less attractive.

“In many ways, the risk for investment grade credit is that the BOJ normalizes policy before the next US downturn,” according to Steve Caprio, head of European and US credit strategy at Deutsche Bank AG. “Japanese inflows have limited investment grade credit spread widening in past sell offs. But if the BOJ normalizes policy, this flow may be quite muted when it is most needed.”

Reduced demand from the deep-pocketed investors for blue-chip debt would likely translate to higher borrowing expenses for US corporations, which are already facing some of the highest financing costs since the financial crisis. Yields have risen to 6.07%, rivaling those seen in 2009, according to the Bloomberg US aggregate index. They were below 2% just over two years ago.

Still, “any reduction in foreign purchases needs to be seen in context of a public market credit space that is shrinking due to low issuance levels and market share erosion to private credit,” said Fraser Lundie, head of fixed income at Federated Hermes Inc. in London. “Technicals are likely to remain well underpinned in the current market environment.”

The pullback has also extended to collateralized loan obligations, with at least one major Japanese investor cutting its allocation to new CLO deals by more than 70% because returns in their domestic market are becoming increasingly attractive, according to a person with knowledge of the matter.

Currency hedging costs are also factoring into that decision, the person said, making domestic bonds even more attractive, while the strength of the dollar means their CLO holdings have risen in value in local currency, making additions less appealing.

While Japanese investors have sold out of corporate bonds, they bought the most US sovereign bonds in six months in September, in part because many insurers are now looking at buying the securities on an unhedged basis. Sumitomo Life Insurance Co., for example, may boost holdings in overseas bonds that it doesn’t hedge against currency fluctuations.

Read More: Sumitomo Life to Shun Hedged Foreign Debt, Buy Other Assets

High yields from US bonds remain attractive to some credit buyers, though “there are a set of investors who are waiting to get out of underwater hedged bond purchases that they have to hold to maturity,” said Brad Setser, a senior fellow at the Council on Foreign Relations who researches capital flows and financial vulnerabilities.

“The big ‘bid’ of the past was a hedged bid, and I don’t expect that to come back — but I also don’t currently see signs of a rush to liquidate legacy bond holdings.”

Week in Review

- Treasuries tumbled Thursday after one of the worst 30-year bond auctions of the past decade and hawkish comments on interest rates by Federal Reserve Chair Jerome Powell.

- Traders in the $26 trillion Treasury market were finding it hard to settle trades more than a day after a cyberattack on ICBC.

- WeWork Inc.’s first appearance in bankruptcy court kicked off a process to decide how creditors should divide the remains of a once high-flying company that can’t afford to repay more than $4 billion.

- Partners Group Holding AG is set to finance the potential purchase of Rosen Group with bank funding, dealing a blow to private credit funds keen to back the deal.

- UBS Group AG’s sale of additional tier 1 bonds, its first since Credit Suisse roiled the market with a historic writedown, pulled in roughly 10 times the bids for the debt on offer.

- After letting two of the world’s biggest property developers plunge into default, Chinese authorities are attempting to save a third industry giant from following suit.

- Oaktree Capital Group LLC continues to look for opportunities in China’s loan market, said Co-Chairman Howard Marks, even as global investors remain concerned about the country’s investability.

- Sculptor Capital Management is buying more loans from AccorInvest Group SA, positioning itself as a key lender ahead of a refinancing.

- Adevinta ASA’s private equity suitors are progressing in negotiations on a takeover of the company, which is set to be one of the year’s biggest buyouts.

- Private equity firms are increasingly leaning on businesses outside of traditional buyout strategies and taking a sharper look at costs as they battle a prolonged dealmaking slump.

- US banks are doling out fewer loans to businesses as lending standards tighten and demand weakens after 11 interest-rate hikes by the Federal Reserve, suggesting economic growth could slow as credit contracts.

- DoubleLine Capital is making its most aggressive bet on high-quality corporate bonds in years, wagering that the highest yields since the global financial crisis will offset risks posed by an economic slowdown.

On the Move

- Oaktree Capital Management has hired former Apollo Global Management Inc. managing director Olivia Guthorn.

- Manulife Financial Corp. hired David Loh, the head of capital markets at HSBC Securities Canada.

- Banco Santander SA has recruited UBS Group AG’s Grant Byczek for a senior leveraged finance trading role.

- Moody’s Investors Service promoted Ana Arsov to global head of private credit, as part of the creation of a new franchise within the company that will focus on that sector.

- Vinland Capital, a Brazilian hedge fund co-founded by former Goldman Sachs Group Inc. partner Andre Laport, hired the head of credit risk at Banco Santander SA’s local asset-management unit as it expands its credit business.

- Alinor Capital Management, the fledgling distressed-debt hedge fund, is in the process of hiring a former Attestor Capital LLP trader.

--With assistance from Olivia Raimonde and Josyana Joshua.