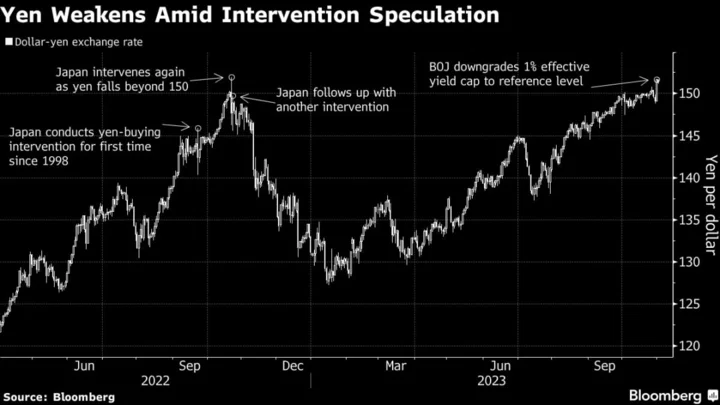

The contradictions in Japan’s efforts to protect the yen while slowing the pace of rising bond yields are becoming increasingly clear in currency and debt markets.

While Thursday presents a slightly different picture after the Federal Reserve kept rates on hold, the action in Tokyo on Wednesday underscores Japan’s huge challenge.

The day began with the nation’s top currency official at the finance ministry giving one of the starkest warnings yet that authorities were ready to intervene in the foreign exchange market to stem the yen’s fall. By lunchtime the Bank of Japan was preparing to wade into the debt market to slow the speed of the 10-year bond yield’s ascent toward 1%.

The BOJ’s unscheduled bond purchases were jarring — coming just 24 hours after the central bank removed its 1% cap on these yields. The operation also worked directly against efforts to support the yen, which is being weighed down by the wide gulf between interest rates in Japan and the US.

The upshot for the currency was a 0.5% advance Wednesday and a further 0.2% gain so far Thursday. That’s taken it away from the 151 level versus the dollar, but it remains well within sight if its 33-year low set last year. The 10-year bond yield still ended up for the day and was just 1.5 basis points below the fresh decade high it set before the central bank announced its buying operations. Bond futures point to lower yields Thursday while the longer-term picture for gains is unchanged, and a 10-year debt auction due later in the day has traders on edge.

“The MOF and BOJ’s actions are out of sync,” said Tsuyoshi Ueno, senior economist at NLI Research Institute, who sees the answer to the problem lying out of their hands and in any future interest rate cuts in the US. “Until then, authorities will have to be patient.”

Speculators in both markets are betting that Japan’s policymakers won’t be able to maintain their balancing act, and the stakes are rising. An excessive yen depreciation could worsen Japan’s inflation, in part by pushing up import prices, while higher yields could prematurely crimp Japan’s recovery.

“We’re on standby,” said Masato Kanda, the top currency official at the ministry, echoing language he used a year ago on the day Japan made the first of three forays into the market. “But I can’t say what we’ll do, and when — we’ll make judgments overall, and we’re making judgments in a state of urgency.”

Read more: Japan Ramps Up Yen Intervention Warning After BOJ-Fueled Selloff

His comments on Wednesday followed the yen’s biggest one-day drop since April on Tuesday after the BOJ’s underwhelming tweak to its cap on bond yields showed that moves away from ultra-loose policy would likely continue to be slow and gradual.

Japan’s stock market, on the other hand, saw the Topix index climb the most in more than a year because of the tailwind to equities from low borrowing costs and the yen weak.

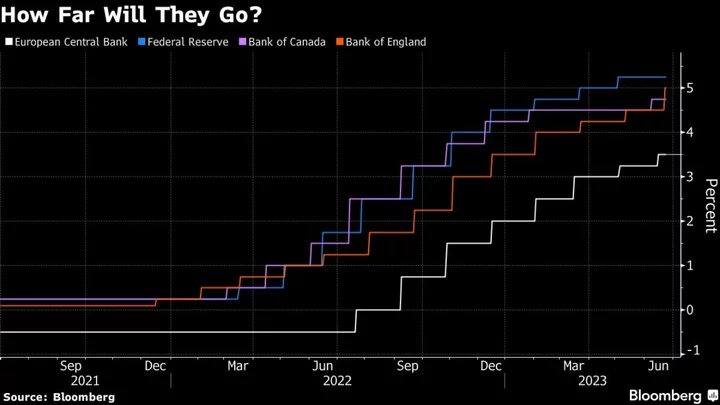

While Japan’s the 10-year benchmark yield had doubled since July 27, one day before Governor Kazuo Ueda made his first tweak to yield-curve control, it is still about four percentage points below its US equivalent.

The BOJ appears intent on moderating moves while traders are constantly trying to push yields higher.

“Although the BOJ took action to discourage rises in yields, market players probably want to see the long-term yield reaching 1%,” said Keisuke Tsuruta, a senior fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities Co.

He added that the unscheduled buying operation this time may have been a pre-preemptive move before the closely-watched 10-year bond auction Thursday.

BOJ Buys More Bonds to Slow Rising Yields a Day After Tweak

“At the bottom of the BOJ’s thinking is its lack of assurance that they could achieve sustainable inflation of 2%, so a somewhat easy monetary policy needs to be maintained,” said Shusuke Yamada, head of Japan currency and rates strategy at BofA Securities Inc. “For the finance ministry, it’s looking at volatility and trading levels for foreign exchange. Letting the yen weaken has disadvantages for consumers.”

--With assistance from Yumi Teso and Daisuke Sakai.

(Adds latest prices)