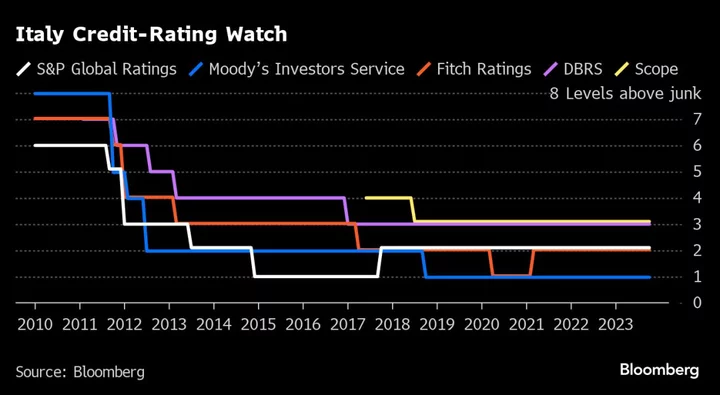

Italy was confirmed at two steps above junk by Fitch Ratings, giving Prime Minister Giorgia Meloni another boost amid heightened scrutiny on the public finances.

The country remains at BBB with a stable outlook in a third consecutive endorsement of the country’s fiscal stance after a budget that acknowledged the path to debt consolidation will take longer than originally envisaged.

“Italy’s rating is supported by its large, diversified and high value-added economy, eurozone membership, and strong institutions relative to the peer group median” Fitch said in a statement released on Friday. “These credit features are balanced against weak macroeconomic and fiscal fundamentals, in particular very high government debt, a comparatively loose fiscal stance since the pandemic, subdued economic growth potential and more recently, the higher yield environment.”

Any sense of elation for Meloni may be overshadowed by suspense over the prospect of an arguably more precarious announcement penciled for next week. Moody’s Investors Service could reveal then whether it will convert its own negative outlook into Italy’s first-ever assessment as a junk borrower.

Fitch’s affirmation follows a budget that drew out the country’s horizon for debt reduction to deliver on promises to voters — while also nursing public finances hit by sputtering economic growth and rising borrowing costs.

Last month, the company observed that the populist government’s new projections meant that borrowings as a percentage of output would drop less than it forecast in May.

The International Monetary Fund agrees. It now reckons that ratio will still be stuck above 140% in five years — more than 8 percentage points higher than it predicted in April.

The coalition’s wider deficit forecasts have unnerved some investors, pushing the spread between Italian and German 10-year bonds higher.

Fitch’s unchanged rating chimes with those of some rivals. Last month, S&P Global Ratings maintained a stable outlook on its own BBB rating — also two steps above junk. S&P predicted a pickup in growth by 2025, helped by accelerated European Union recovery fund spending.

DBRS Morningstar confirmed its own even-higher assessment, observing that Italy’s debt ratio, while high, has still fallen much more than it anticipated.

By contrast, Moody’s has shown far more concern at the state of the public finances. Its own potential announcement is scheduled for Nov. 17, though the company could simply refrain from publishing one.

The upcoming Moody’s evaluation showcases how Meloni faces a hard road ahead as she confronts weak economic output, which is seen growing just 0.7% this year, according to the Bank of Italy. Higher borrowing costs and slumping global trade are also hurting the country’s businesses.

The government has pledged growth-boosting investments, but it’s also struggling to spend EU recovery funds that could help improve infrastructure.

Meloni’s coalition is still trying to keep promises to voters, including tax cuts and aid to lower income families. That’s made it tougher to bring the deficit as a percentage of gross domestic product below the European Union’s limit of 3% until 2026 — a year later than originally planned.