Corporate America is signaling that angst around price pressures runs deep, even as the Federal Reserve’s campaign to tame inflation by raising interest rates is bearing fruit and likely approaching an end.

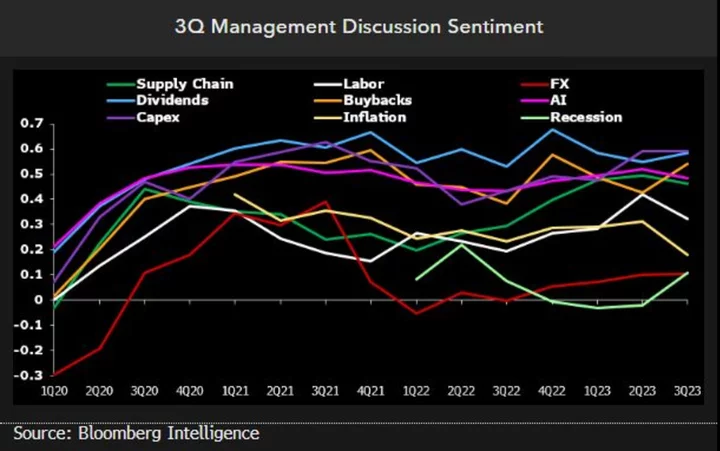

Among corporate managers, sentiment around inflation has soured to a degree last seen in early 2021, according to a Bloomberg Intelligence study of transcripts from earnings calls this reporting cycle. Anxiety about labor costs is mounting as well, giving Wall Street analysts covering companies more ground for concern.

The BI analysis — which counts “positive” and “negative” words executives use to discuss certain topics — doesn’t necessarily mean inflation is as big of an issue as it was two years ago. But as a barometer of sentiment, it likely shows their frustration with price pressures remaining sticky and with wage costs crimping margins, says Wells Fargo Investment Institute’s Sameer Samana.

“There could be some residual worries around the fact that it hasn’t come down faster, and that the Fed is remaining tighter for longer because of it,” Samana, the firm’s senior global market strategist, said by email. “It’s probably also problematic that once prices go up, they don’t come down, even if inflation comes down.”

BI’s study, which covers earnings reports for roughly half of S&P 500 firms, suggests why Fed officials saw the need to signal this week that they’re not quite ready to declare an end to their tightening campaign. In the eyes of executives, things aren’t terrible, as more are hopeful than pessimistic about consumer prices. But that optimism is fading.

Read more: Powell Says Fed to Be Careful, Won’t Hesitate to Hike If Needed

The issue is that consumer inflation has started to tick up again since mid-year, putting more pressure on policymakers. It could be one reason for the grim take on the topic during conference calls, said Gillian Wolff, a BI equity strategist.

“The Fed is really trying to manage this in a balanced way, and I believe they’re more fearful about not having inflation under control than they are about a recession,” said Ann Miletti, head of active equity at Allspring Global Investments.

As for what that means for corporations, they’re struggling with their outlooks “because they don’t have great visibility today,” she said. “So they’re managing their business for what they see in the short term.”

BI’s analysis shows sentiment is also weakening around wage costs, and that pressure is showing up in share prices. A basket of S&P 500 Index stocks with the steepest labor costs — stripping out any industry bias — trailed its lower-cost counterpart by 3.9 percentage points last quarter, the biggest lag since early 2021, data compiled by Goldman Sachs Group Inc. show.

“Labor is being mentioned more frequently, so it’s possible that rising costs in general are starting to raise concerns again,” said BI’s Wolff.

Investors get a fresh read on inflation next week. Wall Street expects the consumer price index to show a slower rise, increasing at a 3.3% annual pace in October, down from 3.7% in September, according to a Bloomberg survey of economists.

Meanwhile, earnings reports from Walmart Inc., Target Corp. and Ross Stores Inc. will offer an update on how consumers are dealing with rising prices and climbing borrowing costs. That’s especially important with the year-end holiday shopping season coming up.

Read more: US Holiday Sales Growth to Moderate This Year, Retail Group Says

“For the first time in a couple of years, the risks are becoming more symmetric — with the risk of inflation remaining sticky slightly above target to be weighed against the risk of weaker activity,” Goldman Sachs strategists including Dominic Wilson wrote in a note to clients.

--With assistance from Katrina Compoli.