Sign up for the India Edition newsletter by Menaka Doshi – an insider's guide to the emerging economic powerhouse, and the billionaires and businesses behind its rise, delivered weekly.

Indian Renewable Energy Development Agency Ltd., an Indian state-owned lender to renewable energy projects, surged in its trading debut in Mumbai, underscoring investor interest in sustainability-related companies in the South Asian country.

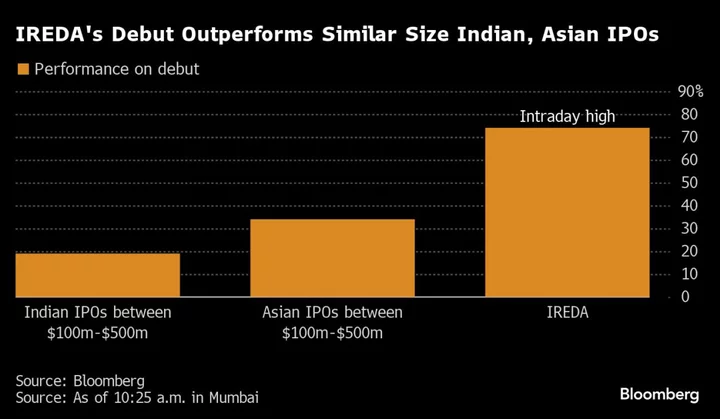

The stock began trading at 50.31 rupees versus an offer price of 32 rupees, and rose as high as 55.70 rupees in early trade. Demand exceeded shares on offer by almost 40 times, as investors piled into the company that’s likely to benefit from plans to expand the nation’s renewable capacity.

The stock was “fairly valued” at the offer price and in line with peers, Ethan Aw, an analyst at Aequitas Research wrote on Smartkarma prior to the debut. Strong demand from institutions boosted subscription rates for the IPO that raised 21.5 billion rupees ($258 million), he said.

Read More: Green Lender’s Hit IPO a Thumbs Up for India’s Transition: BNEF

Companies that started trading in India after raising between $100 million and $500 million rose 19% on average on their first day of trade, according to data compiled by Bloomberg.

IREDA is the largest new share sale by an Indian state-run entity since the Life Insurance Corp. of India’s record debut in May 2022. The newcomer is the nation’s largest shadow lender focusing on green financing and is seen as a front-runner to fund such projects estimated to be worth nearly 28 trillion rupees.

“There is going to be massive growth in spending on renewables and there are very few specialized agencies working in this area, which makes companies such as IREDA attractive,” said Jigar Shah, head of sustainability research at Maybank Investment Banking Group.

(Updates with analyst comment in final paragraph.)