European stocks rise ahead of inflation data, central bank meetings

By Elizabeth Howcroft LONDON (Reuters) -European stocks rose in early trading on Monday and world stocks were just below 13-month

2023-06-12 17:26

BYD Showcases Electric Prowess at Japan Mobility Show 2023: A First for Chinese Automakers

TOKYO--(BUSINESS WIRE)--Oct 25, 2023--

2023-10-25 17:55

Citadel Securities Boosts Fixed-Income Presence With New Bond Trade

Ken Griffin’s market-making giant is poised to offer trades in zero-coupon Treasuries, as it ramps up its presence

2023-08-10 05:25

Kansas farmers abandon wheat fields after extreme drought

By Tom Polansek WICHITA, Kansas Farmers in Kansas, the biggest U.S. producer of wheat used to make bread,

2023-05-23 00:54

Euro 7 emissions standard to cost many times EC forecasts -industry group

By Nick Carey LONDON Proposed Euro 7 emissions regulations will lead to direct costs for auto manufacturers that

2023-05-23 14:20

McDonald's posts surprisingly strong sales after "happy birthday" Grimace campaign goes viral

McDonald’s is grinning thanks to Grimace after a marketing campaign to celebrate the “birthday” of its big purple mascot went viral and contributed to surprisingly strong second quarter sales

2023-07-27 19:15

Analysis-Investing in AI: how to avoid the hype

By Naomi Rovnick LONDONExperienced tech investors are hunting for undervalued opportunities in an over-valued space. At stake is

2023-05-26 13:16

Teledyne FLIR Defense Signs $31 Million Contract with Kongsberg Defence & Aerospace for C-UAS Systems for Ukraine

BOSTON--(BUSINESS WIRE)--Aug 29, 2023--

2023-08-29 20:27

Jordan Explores Alternatives to Israeli Gas Amid Supply Concerns

Jordan is exploring alternatives to natural gas supplies from Israel amid concerns of a possible interruption, state-run Al

2023-11-27 05:21

Billionaire Adani Gets Final Nod to Revamp Famous Mumbai Slum

Billionaire Gautam Adani’s real estate unit received final approval to start the redevelopment of Dharavi, one of Asia’s

2023-07-15 12:53

Yen Surges From Weakest Level in a Year Amid Intervention Talk

The yen surged from the weakest levels in a year amid speculation that Japanese officials were acting to

2023-10-04 07:20

Airgas Featured on Newsweek’s America’s Most Trustworthy Companies 2023 List

RADNOR, Pa.--(BUSINESS WIRE)--May 8, 2023--

2023-05-09 01:24

You Might Like...

Canada's Trudeau convenes a crisis group over Canadian port strike as union gives 72-hour notice

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

Get a lifetime of Microsoft Office with training courses for under £60

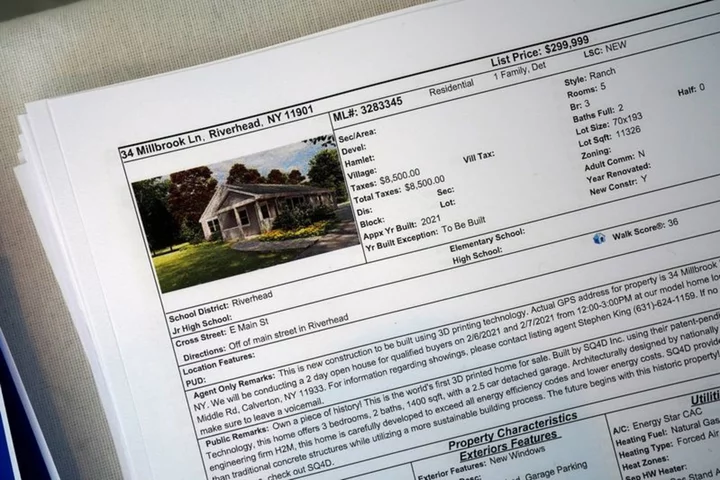

The ultimate wedding gift? Newlyweds want cash for a down payment

Hyundai, Kia to adopt Tesla EV-charging standard from 2024 in US

Rio Tinto reopens iron ore rail line in Western Australia after derailment

US Fed on track for a 'soft landing': senior offical

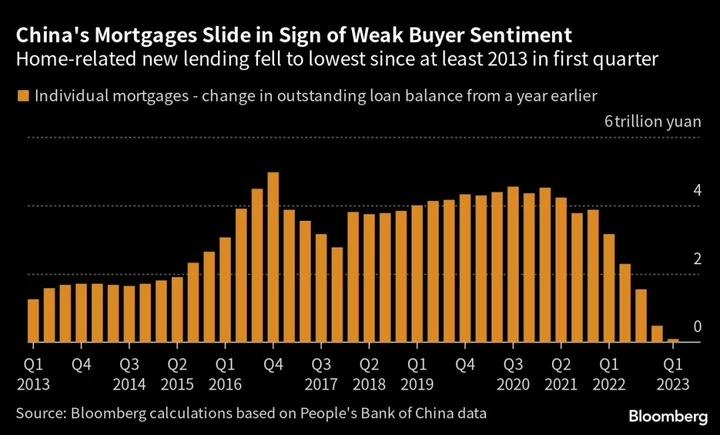

Top China Housing Official Urges Fresh Property Aid Efforts